Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Hawkish Fed comments push Bitcoin price and stocks lower again

The crypto markets had started the week with a spring in their step.

Last Sunday, Elon Musk revealed that Tesla would be prepared to accept Bitcoin as a payment method again — once it could be proved that 50% of the energy used by miners comes from clean, renewable sources.

Traders reacted positively to the tweet, and there were green candles aplenty. Upbeat sentiment helped drive Bitcoin above $40,000 for the first time in over a fortnight. Unfortunately, though, it seems prices above this level were unsustainable.

A new wave of selling reared its ugly head days later after Federal Reserve chairman Jerome Powell suggested that interest rates may rise in 2023 — a year earlier than planned. Other officials went further, indicating the first increase could happen in late 2022.

Bitcoin wasn’t alone in suffering the sell-off. Stocks and gold also fell, eating away at the narrative that BTC is an uncorrelated asset.

With prices falling as low as $35,000, there are now fears that a “death cross” may be forming for Bitcoin. Some traders are forecasting that $32,500 could be the next stop before BTC revisits the swing low at $30,000.

World Bank refuses El Salvador’s request for help on BTC transition

As determined as El Salvador’s president may be to introduce Bitcoin as legal tender, a series of unfortunate events this week showed that it’s harder than it looks.

The World Bank has refused to assist the country in its transition, citing “the environmental and transparency shortcomings” associated with the digital asset.

Although prominent Bitcoiners weren’t pleased with the World Bank’s refusal, it’s fair to say that they weren’t surprised either.

One particularly sarcastic contribution came from Blockstream’s chief strategy officer Samson Mow, who tweeted: “BREAKING: WORLD BANK CANNOT HELP EL SALVADOR MAKE WORLD BANK OBSOLETE.” Miaow.

Elsewhere, an El Salvadorean minister denied reports that the country was examining the possibility of using Bitcoin for salary payments, warning such talk was “too premature.”

Economists have also been continuing to issue warnings about the potential ramifications of El Salvador’s move. Steve Hanke pulled no punches when he said going through with this law has the potential to “completely collapse” the country’s already fragile economy.

Striking a cheery note, he said the politicians who backed President Nayib Bukele’s Bitcoin Law were “stupid,” adding: “You’re not going to pay for your taxi ride with a Bitcoin. It’s ridiculous. […] 70% of the people in El Salvador don’t even have bank accounts.”

Mark Cuban calls for stablecoin regulation in wake of Iron Finance “bank run”

Billionaire crypto enthusiast Mark Cuban has called for stablecoins to be regulated after losing money in a dramatic “rug pull.”

Iron Finance fell victim to a “historical bank run” that detailed the price of the IRON stablecoin. Consequently, the value of its native token TITAN crashed by almost 100% over two days — from all-time highs of $64.04 to a mere fraction of one cent.

In an email sent to Bloomberg, Cuban wrote: “Even though I got rugged on this, it’s really on me for being lazy. The thing about DeFi plays like this is that it’s all about revenue and math and I was too lazy to do the math to determine what the key metrics were.”

Crypto Twitter, already reeling from the U-turn performed by Elon Musk, wasn’t a fan of Cuban’s remarks.

Kraken’s CEO Jesse Powell said a lack of regulation wasn’t the problem, tweeting: “Not doing your own research and YOLOing in to a terrible investment because your time was worth more than your money is your problem.”

The death of NFTs? CNN, Fox, Mila Kunis (and the U.S. Space Force) don’t think so

Earlier this month, some critics were sounding the death knell for nonfungible tokens after a Protos report suggested that sales had slumped by 90% since the peak in early May. However, things may not be as dire as they first appear.

First off, let’s not forget that Sotheby’s auctioned off a rare CryptoPunk for $11.8 million earlier this month… setting a new world record in the process. Also, it’s worth noting that there’s no shortage of new NFT announcements.

Here’s just a few that have emerged in recent days. CNN said that it’s planning to tokenize historic moments from the news. That came as Fox, another U.S. media behemoth, revealed it’s launching a $100 million fund for NFT content creation. Sotheby’s confirmed that it is going to auction off the source code for the World Wide Web in the form of a digital collectible. And not to be outdone, A-lister Mila Kunis is wading into the “very masculine” crypto space by launching her very own NFT project.

Even the much-ridiculed U.S. Space Force thinks that NFTs are out of this world. Its tokens are literally going to the moon —paying tribute to Neil Armstrong, the first person to set foot on the lunar surface.

Given how all of these projects have the chance to capture the public’s imagination, it may be unwise to characterize NFTs as a passing fad that’s fading away.

‘I have nothing’: Imprisoned John McAfee claims his crypto fortune is gone

Still behind bars in Spain as he battles extradition to the U.S., antivirus software pioneer John McAfee has told his one million Twitter followers that he doesn’t have hidden crypto.

He wrote: “I wish I did but it has dissolved through the many hands of Team McAfee (your belief is not required), and my remaining assets are all seized. My friends evaporated through fear of association.”

And, striking a defiant note, he added: “I have nothing. Yet, I regret nothing.”

A Spanish court is set to make a decision on whether to approve McAfee’s extradition within days. The businessman is accused of tax evasion and failing to declare income from paid crypto promotions, consultancy work, and gains from his investments.

During a court hearing earlier this week, he claimed the charges against him were politically motivated — and that he would die behind bars if he is flown to the U.S.

Winners and Losers

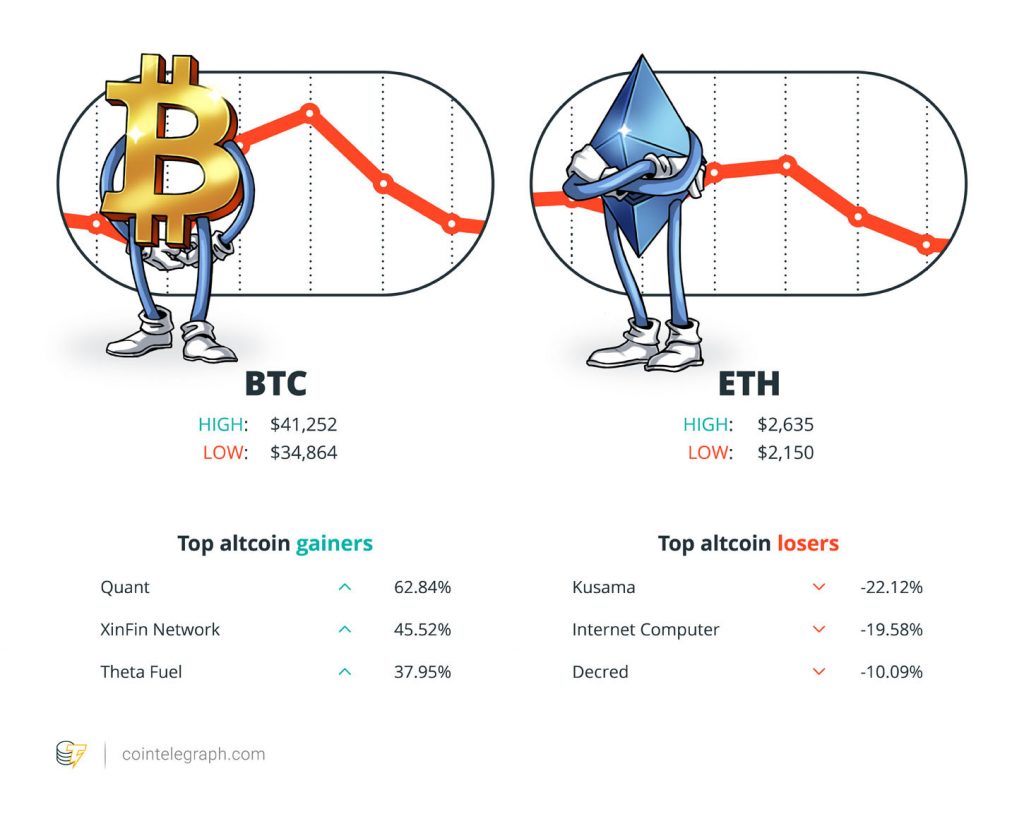

At the end of the week, Bitcoin is at $35,702.06, Ether at $2,228.54 and XRP at $0.79. The total market cap is at $1,496,219,684,262.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Quant, XinFin Network and Theta Fuel. The top three altcoin losers of the week are Kusama, Internet Computer and Decred.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

[Crypto is] the first genuinely new asset class in about 150 years.

Ric Edelman, Edelman Financial Engines founder

While [El Salvador’s] government did approach us for assistance on Bitcoin, this is not something the World Bank can support, given the environmental and transparency shortcomings.

For new investors, it’s best to buy when the market is well below trend. Now is one of those times.

Dan Morehead, Pantera Capital CEO

There’s little risk of the #dollar dropping in value vs. similarly depreciating currencies, which means that diversification into store-of-value assets like #gold and #Bitcoin is simply a prudent move, in our view.

Mike McGlone, Bloomberg Intelligence senior commodity strategist

Michael Saylor is clearly focused on a long-term investment strategy rather than short-term gains or losses. Putting company debt on the line is risky, but it could obviously lead to a massive return as well.

Kadan Stadelmann, Komodo chief technology officer

You’re not going to pay for your taxi ride with a Bitcoin. It’s ridiculous. […] You’ve got 70% of the people in El Salvador don’t even have bank accounts.

Steve Hanke, economist

When more people are buying cryptocurrency than investing in a stock market ISA, you have to conclude the world’s gone crypto crazy.

Laith Khalaf, AJ Bell financial analyst

In my view, it looks like the bottom is in.

Jurrien Timmer, Fidelity Investments director of global macro

Even though Musk is temporarily causing turmoil in the market, his involvement could be beneficial for crypto in the long-term, as he is attracting new people to crypto, albeit for sometimes the wrong reasons.

Erik Nurm, CoinSwap founder

Prediction of the Week

Even Elon Musk can’t save Dogecoin from crashing another 60%, analyst asserts

A dreaded “head and shoulder” pattern has emerged in Dogecoin’s charts — and according to one analyst, this indicates the meme coin’s price could fall by another 67%.

Pseudonymous trader Tyler Durden claimed in a tweet that a fall to $0.05 is “programmed,” adding: “Even Elon can’t save this with his tweets. He’s tried and each time he just created another lower high.” Gulp.

With prices now dipping below $0.30, DOGE is a long way from the all-time highs of $0.73 seen in the first week of May — the culmination of a jaw-dropping 15,000% increase since the start of the year.Interest in the joke cryptocurrency is now falling across several metrics, indicating Doge may have had its day.

FUD of the Week

Scammers mail out fake hardware wallets to victims of Ledger data breach

The consequences of Ledger’s major data breach continue to be felt almost a year later.

A Reddit user who was among those affected claims they received a fake Ledger Nano X wallet in the mail — wrapped in seemingly authentic packaging.

The device came with a poorly written letter purporting to be from the Ledger’s CEO that warned “you must switch to a new device to stay safe.”

Even worse, they also received a fake manual asking them to enter their private Ledger recovery phrase to connect their cryptocurrency wallet to the new hardware.

Crypto fan tokens a mixed bag for game-deprived soccer fans

Not everyone is a fan of soccer fan tokens, it seems.

Organizations representing football fans in England and Wales have accused teams of “trying to squeeze extra money out of supporters” — only to give them a cosmetic say in how clubs are run.

The value of fan tokens plunged along with the rest of the crypto market after peaking in April and May. This volatility, combined with rising matchday costs in general, has left some fans feeling priced out of having their voices heard.

Sue Watson, chair of West Ham United Independent Supporters Association, asked: “Why should you have to pay to have any sort of say in the club?”

This unknown cryptocurrency soared by 164,842% in hours, only to crash 99%

About $7.65 billion entered the cryptocurrency market in just three hours via a widely unknown altcoin on Monday.

WebDollar (WEBD) surged from $0.0003711 to $0.6121 in just three hours — a 164,842% rise in its market valuation.

Over a five-minute period, its market cap went from $1.84 million to $1.5 billion. It had fallen back to $5.12 million 40 minutes later. And, 50 minutes after that, it surged again with a vengeance — hitting a staggering $9.5 billion.

At one point, WebDollar was the 18th-largest cryptocurrency in the world by market cap, leapfrogging the likes of Stellar, VeChain and Tron.

It wasn’t to last. Two hours after topping $9.5 billion, it crashed by more than 99%, with its ranking rapidly falling down to No. 873.

Best Cointelegraph Features

An asset for all classes: What to expect from Bitcoin as a legal tender

New tech that reduces costs of international payments would “be a boon for poor countries that rely on remittances” — but will BTC as legal tender fix that?

Joining the ranks: Bitcoin’s correlation with gold and stocks is growing

BTC used to be an uncorrelated asset, but that’s no longer the case. What can gold and stocks suggest about the crypto markets?

Bullish all the way? MicroStrategy doubles down on its Bitcoin bet

MicroStrategy’s latest bond offering seeks to deliver a yield of 6.25%–6.5% — significantly higher than an average junk bond yield of 4.01%.

Editorial Staff

SBF takes the stand, ‘buy Bitcoin’ searches soar and other news: Hodler’s Digest, Oct. 22-28

Sam Bankman-Fried testifies in court, searches for ‘buy Bitcoin’ surge, and Gemini sues Genesis over collateral.

Read moreNigeria plans CBDC rollout, Salvadoran retirees protest Bitcoin Law, Twitter to add BTC and ETH tipping feature: Hodler’s Digest, Aug. 29-Sept. 4

The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — one week on Cointelegraph in one link!

Read moreHong Kong hoses down stablecoin frenzy, Pokémon on Solana: Asia Express