Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

After 8 years dumping billions of XRP, Jed McCaleb’s stack runs out in weeks

Ripple Labs co-founder and former chief technology officer Jed McCaleb is nearing the end of his eight-year-long XRP dumpathon. The former Ripple exec has been gradually shedding his stash of 9 billion XRP since his departure in 2014. As of June 30, McCaleb only had 81.53 million XRP worth $26.55 million remaining, much to the delight of die-hard Ripple supporters.

[adinserter block=”1″]

80,000 Bitcoin millionaires wiped out in the great crypto crash of 2022

The number of wallets holding over $1 million worth of Bitcoin has decreased by roughly 80,000, from 108,886 on Nov. 12 to a mere 26,284 as of June 30. That represents a 75% plunge within nine months. However, with the price of BTC crashing down to the $20,000 region and potentially lower, it may also give more people a chance to become whole coiners.

Ethereum fork a success as Sepolia testnet gears up to trial the Merge

On Thursday morning, the Gray Glacier hard fork designed to delay the difficulty bomb successfully went live on Ethereum. The hard fork will delay the difficulty bomb by roughly 100 days as developers work to get the final stages of the Merge completed. Over the next few days, the Sepolia testnet is also set to run through its Merge trial, making it the second of three public testnets to do so.

Bear market will last until crypto apps are actually useful: Mark Cuban

Billionaire investor and Dallas Mavericks owner Mark Cuban thinks the current bear market won’t be over until there’s a stronger focus on applications that provide utility. Speaking on the Bankless podcast, he noted, “It lasts until there’s a catalyst and that catalyst is going to be an application, or we get so low people go ‘fuck it, I’ll buy some.’”

BlockFi announces deal with FTX US, including ‘option to acquire’ for $240M

Amid rumors that FTX US was planning to acquire beleaguered crypto lender BlockFi for as little as $25 million, BlockFi CEO Zac Prince revealed Friday that the actual deal was more costly. According to Prince, BlockFi signed agreements with the derivatives exchange for a $400-million revolving credit facility. As part of the deal, FTX US will have the ability to purchase BlockFi outright for up to $240 million. Still, that’s a drop in the bucket compared with BlockFi’s valuation this time last year, which was roughly $5 billion.

[adinserter block=”1″]

Winners and Losers

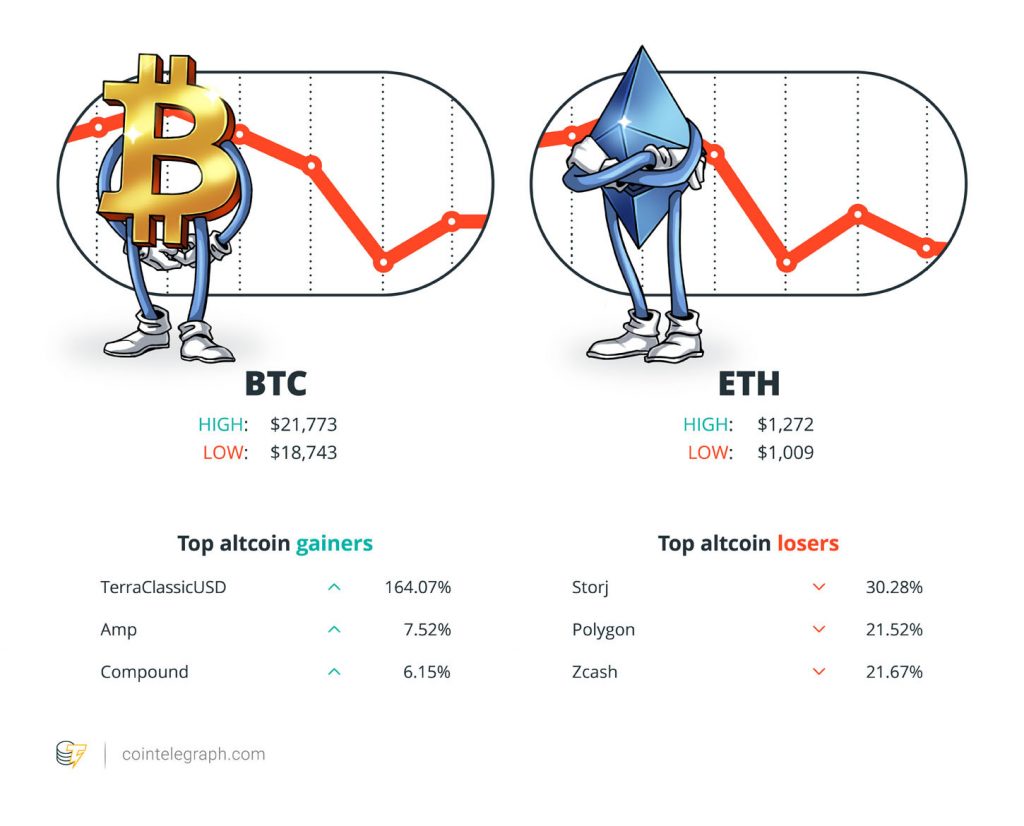

At the end of the week, Bitcoin (BTC) is at $19,433.55, Ether (ETH) at $1,058.95 and XRP at $0.31. The total market cap is at $867.7 billion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are TerraClassicUSD (USTC) at 164.07%, Amp (AMP) at 7.52% and Compound (COMP) at 6.15%.

The top three altcoin losers of the week are Storj (STORJ) at 30.28%, Polygon (MATIC) at 21.52% and Zcash (ZEC) at 21.67%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

Anonymous is looking into Do Kwon’s entire history since he entered the crypto space to see what we can learn and bring to light.”

Anonymous, hacktivist group

In the midst of this, Bitcoin and Ethereum have both traded below their previous cycle ATHs which is a first in history.”

Glassnode, Blockchain analysis firm

A very solid use case for crypto is becoming apparent in the gaming industry, where people invest time that you can earn from it, and that’s all arranged by the blockchain.

Maurice Mureau, CEO of Hodl

There has been a real spike in the interest from traditional hedge funds who are taking a look at Tether and looking to short it.”

Leon Marshall, head of institutional sales at Genesis

The metaverse is a market opportunity, a way to re-engage talent, and a path to connect people across the globe through a new collaborative experience.

Laura Newinski, deputy chair and chief operating officer at KPMG

We’ve been so focused on tokens and money and Web3. I think it’s time to refocus on the underlying infrastructure layers that make all of that possible.

Meltem Demirors, chief strategy officer at CoinShares

Prediction of the Week

Dogecoin price could rally 20% in July with this bullish reversal pattern

The price of OG memecoin DOGE appears to have been running through a bump-and-run-reversal (BARR) bottom since May 11, a technical pattern that points to extended trend reversals in a bear market. The pattern consists of three phases: lead-in, bump, and run. As it stands, DOGE appears to be in the bump phase and could be set for a 20% pump to $0.00941 in the near future.

FUD of the Week

Infamous North Korean hacker group identified as suspect for $100M Harmony attack

Prominent North Korea-based hacking syndicate the Lazarus Group has been identified as a key suspect behind the recent $100 million Harmony protocol hack. According to a report published on Thursday by blockchain analysis firm Elliptic, the way in which Harmony’s Horizon bridge was hacked and the stolen assets laundered bears a striking resemblance to previous Lazarus hacks, such as the $600 million Axie Infinity hack in April.

Singapore reprimands 3AC for providing false information

The potentially insolvent crypto hedge fund Three Arrows Capital (3AC) has been reprimanded by the Monetary Authority of Singapore for providing inaccurate information regarding the number of assets it owned. When 3AC was registered in Singapore in 2013, it was permitted to manage funds for up to 30 investors worth up to $180 million, but it appears there may have been some alleged smudging of the lines in the name of supposed compliance.

OpenSea data breach causes massive leak of users’ email addresses

NFT marketplace giant OpenSea issued a warning to users on Thursday that a list of customers’ emails had been leaked to an outside party. The leak happened via an employee of Customer.io, a platform for managing email newsletters and campaigns. The firm warned users to be on the lookout for potential phishing attacks.

Best Cointelegraph Features

Thailand’s Crypto Utopia — ‘90% of a cult, without all the weird stuff’

The story of how a Bitcoin OG set up a libertarian crypto community and commune for digital nomads on beautiful islands in Thailand three times — and why he hasn’t yet given up on the dream.

Governments, enterprise, gaming: Who will drive the next crypto bull run?

With all the recent turbulence in the crypto space, the question of the moment is: What will drive the next crypto bull run?

Metaverse fractional ownership to form similarly to property loans: Casper exec

Ralf Kubli said that smart contracts can create fractionalization agreements and divide plots of metaverse land that can be leased out individually.

Editorial Staff

SEC sues Do Kwon, Paxos ready to litigate, SBF’s VPN: Hodler’s Digest, Feb. 12-18

Top Stories This Week Paxos ‘categorically disagrees’ with the SEC that BUSD is a security The United States Securities and Exchange Commission (SEC) has defined the stablecoin Binance USD (BUSD) as a security in a Wells Notice sent to its issuer, Paxos Trust Company. The SEC alleges the organization failed to register BUSD under federal […]

Read moreBitcoin dominance will fall in 2025: Benjamin Cowen, X Hall of Flame

The money printer will crank up in 2025 and Bitcoin dominance will fall, says Into The Cryptoverse founder Benjamin Cowen. X Hall of Flame.

Read moreHong Kong hoses down stablecoin frenzy, Pokémon on Solana: Asia Express