Indian crypto holders branch out beyond Bitcoin: Survey

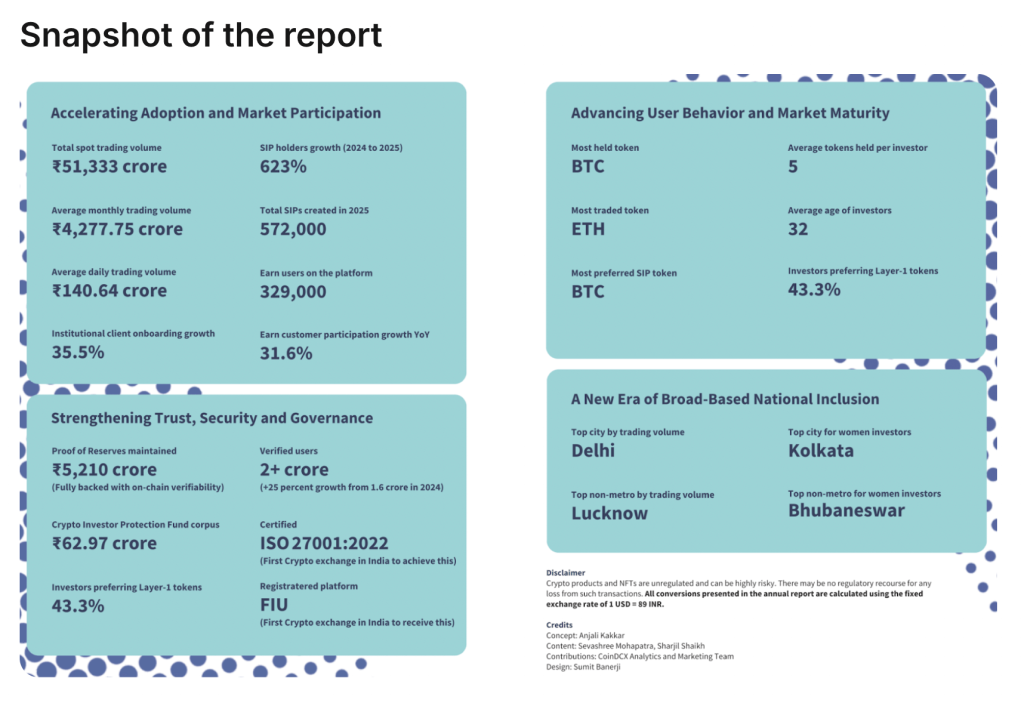

The average crypto holder on the popular Indian crypto exchange CoinDCX is starting to diversify their portfolio, according to recent survey results.

“The Indian crypto investor today holds an average of 5 tokens per portfolio,” CoinDCX said in an annual report released on Thursday. Its survey indicates the average investor in India has almost doubled the range of crypto tokens they hold, up from around two to three tokens in 2022.

CoinDCX said that investors are increasingly exploring the potential of other blockchain networks rather than focusing solely on Bitcoin.

“Investors are evolving beyond Crypto equals Bitcoin”

Layer-1 tokens were the most popular category, preferred by 43.3% of respondents, which CoinDCX described as “a clear indicator of research-driven diversification rather than single-asset speculation.”

Bitcoin followed with 26.5%, while memecoins accounted for 11.8% of investor preference.

The survey also highlighted the growing geographic spread of crypto adoption in India, with 40% of investors based in non-metro cities rather than major urban centers.

The findings come only months after Coinbase Ventures, the investment arm of the US-based crypto exchange Coinbase, invested an undisclosed amount in CoinDCX, amid the country’s bolstering crypto adoption.

CoinDCX recently claimed to serve more than 20 million customers in India and the United Arab Emirates, following its acquisition of local crypto exchange BitOasis in late 2024.

Ripple secures approval to expand operations in Singapore

Singapore’s central bank has given the green light to payment issuer Ripple to further expand services within the country.

“The @MAS_sg has approved an expanded scope of payment activities for our Major Payment Institution license – enabling us to deliver end-to-end, fully licensed payment services to our customers in the region,” Ripple said on Monday.

Ripple said the license will allow them to build the infrastructure that financial institutions need to “move money efficiently, quickly, and safely.”

Fiona Murray, Ripple Asia Pacific vice president and managing director, said that the Asia Pacific region leads the world in crypto usage, and Singapore sits “at the center of that growth.”

The Monetary Authority of Singapore (MAS) has been collaborating with a range of crypto companies in recent years to strengthen crypto innovation in the country.

Major crypto exchange Coinbase recently launched operations in Singapore, citing its “recent foundational work” with MAS as a key factor behind the decision.

The development comes as Ripple continues to engage closely with regulators worldwide. On Nov. 11, Ripple President Monica Long said she welcomed the UK’s Economic Secretary to the Treasury, Lucy Rigby, to Ripple’s Singapore office.

Japan to tax crypto like stocks in big shake-up

Japan is reportedly considering a plan to set a flat tax on cryptocurrency gains at 20%, aligning it with the tax treatment of stocks and other investments.

If implemented, the change may provide significant relief for high-income earners. Under the current tax system, crypto gains are combined with salary and other income and can be taxed at rates of up to 55%, according to a report published by Nippon on Monday.

Many market participants anticipate this to be a bullish move for the country and potentially one that will lead to more capital flowing into the crypto sector.

It was only a few months ago that Dragonfly Capital managing partner Haseeb Quirishi said, “Japan is a sleeping giant in crypto.” Meanwhile, Kaia’s official account said on Monday that, “Japan’s 20% flat tax puts it ahead of most Asian countries on crypto.”

The move comes as the government is also reportedly planning tighter regulation of crypto assets next year.

On Nov. 21, it was reported that the Financial Services Agency in Japan will require cryptocurrency exchanges to maintain liability reserves as part of measures to guard against hacks or unforeseen events.

Ciaran Lyons

Manzi the magnificent: From millionaire at 16 to incredible IoT inventor

“Devices now for the first time can kind of open up and start talking to each other because of the technology that blockchain provides.”

Read moreChinese Tether laundromat, Bhutan enjoys recent Bitcoin boost: Asia Express

Tether launderers sentenced as Bhutan’s Bitcoin hodling places it as the fourth largest among governments: Asia Express.

Read moreWeb3 games shuttered, Axie Infinity founder warns more will ‘die’: Web3 Gamer