Is this crypto market cycle over after four years — or should the four-year crypto market cycle theory itself be consigned to history?

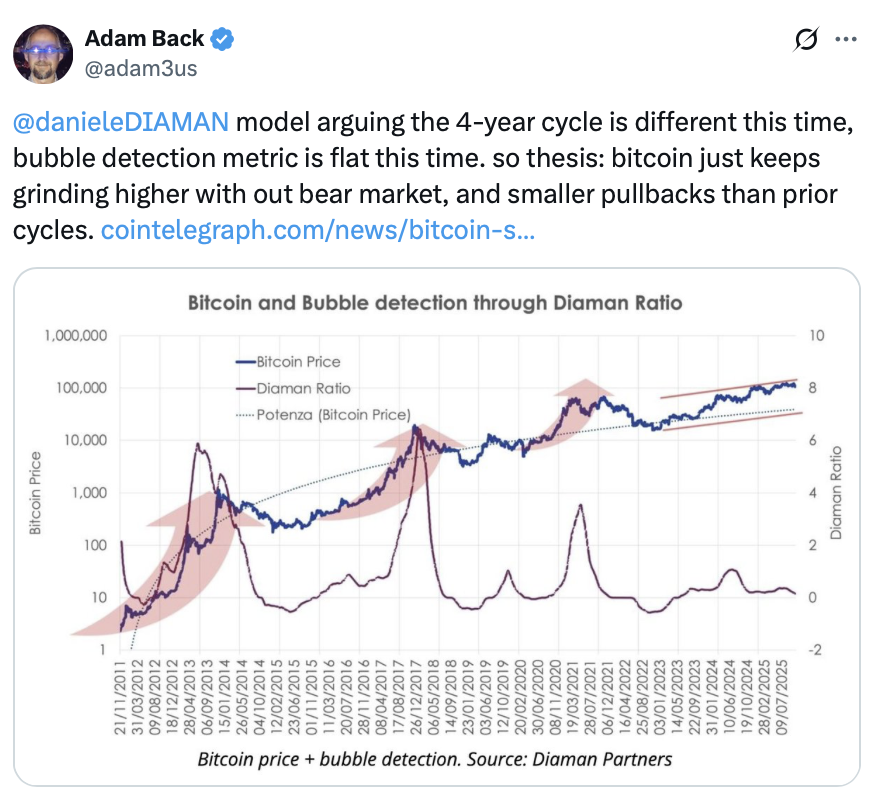

Swan Bitcoin CEO and Bitcoin advocate Cory Klippsten leans toward the latter view. “There is a very good chance that Bitcoin’s famous four-year price cycles are over, killed by institutional adoption,” Klippsten tells Magazine.

The debate has Bitcoin analysts around the world divided. Some insist the four-year cycle is still alive; others say it is dead and argue that Bitcoin is following a completely different path altogether.

So who’s right?

We’re now halfway through what’s usually Bitcoin’s strongest month of the year, yet the price is now lower today than it was on Jan. 1. At the time of writing, Bitcoin was trading at $92,170, down almost 13% over the past seven days. Not exactly great news for the Tom Lees and Arthur Hayes of the world who were calling for $250,000 by the end of the year.

If Bitcoin’s four-year cycle were still in play, Bitcoin’s October all-time high of $125,100 would technically mark the cycle top.

That’s roughly 18 months after the April 2024 Bitcoin halving event, which fits the traditional pattern of an 18-month post-halving bull run, followed by a steep correction and a long downturn that typically lasts until the next halving.

Klippsten argues that if Bitcoin hits a new all-time high in 2026 or avoids a drawdown of more than 70%, it would show that the four-year cycle is finished. He thinks that’s likely because the launch of the Bitcoin ETFs in January 2024 changed the game.

Spot Bitcoin ETFs changed Bitcoin’s supply-demand dynamics

Echoing Klippsten, Michaël van de Poppe, founder of MN Trading Capital, says the spot Bitcoin ETF inflows are fundamentally altering Bitcoin’s supply-demand dynamics.

“60K Bitcoin has been bought in the past 18 months in the Bitcoin ETFs, which is a significant constant demand through institutions,” he said. However, van de Poppe warns that declaring the cycle dead is “short-sighted.”

While van de Poppe admitted that “this cycle has been proven to act differently,” he emphasized that October’s all-time high still has a chance of being the cycle top.

“We’re on the crossroads of market changes, maturing of an asset like Bitcoin and therefore, different market dynamics,” van de Poppe said.

Bitwise chief investment officer Matt Hougan is more confident that Bitcoin is moving away from the typical four-year cycle after the recent market downturn. “The biggest risk was [if] we ripped into the end of 2025 and then we got a pullback,” Hougan said, explaining it would have fit the four-year thesis.

BitMEX co-founder Arthur Hayes dismisses the idea that Bitcoin is sticking to the traditional cycle. He went quiet on his $250,000 year-end prediction in his latest Substack post and argued that Bitcoin will only push into new highs once markets “puke enough” to force central banks back into aggressive money printing.

Swyftx lead analyst Pav Hundal is also looking closely at the macroeconomic data, telling Magazine that it’s too early to call a top for this cycle.

“Any drop in inflation or concern over labour figures will just push us back onto the path of rate cuts,” Hundal says.

“Every time the market expects a drop in US rates, we see a bid and rally and then we just get this huge unwinding of risk when rate cut hopes are dashed,” Hundal says.

Is Bitcoin heading for a five-year cycle?

After a bout of uncertainty recently stirred up by the Federal Reserve Chair Jerome Powell, the odds of a December rate cut have plunged to just 40.9%, according to CME’s FedWatch Tool.

Hundal says the market is essentially “fumbling its way through the dark at the moment” until clearer data arrives.

“This isn’t just a Bitcoin problem. It’s a flashing red light for all risk assets,” he adds.

The Fed cutting interest rates is typically bullish for Bitcoin and other crypto assets as traditional assets like bonds and term deposits become less lucrative to investors.

There’s also another group of Bitcoiners who are adamant that the four-year cycle never really existed at all. The Bitcoin Therapist argues it was just Bitcoin moving in sync with the broader business cycle.

Real Vision founder Raoul Pal argued a similar idea, claiming the global business cycle now runs on a five-year period, which may put Bitcoin’s cycle high somewhere in 2026.

Crypto analyst Jesse Eckel said, “In hindsight, it’ll be obvious we were headed into a bull market in 2026 and knowing how to count to four wasn’t a real investment strategy.”

“Five Year Cycle,” Eckel emphasized.

No, it’s a four-year cycle, and it just ended

But some analysts and executives have been saying for months the four-year cycle was likely to still be in play, and the current market carnage supports that perspective… for now at least.

Prominent crypto analyst Rekt Capital said in July that only “a very small sliver of time and price expansion” remained in the current run.More recently, Rekt cautioned that it may take a long time “to conclude whether Bitcoin is in a lengthened cycle or ultimately it wasn’t after all.”

Crypto exchange Gemini’s APAC head Saad Ahmed also believes some kind of repeating cycle will persist, telling Cointelegraph at Token2049 that “the reality is that it’s very likely that we’ll continue to see some form of a cycle.”

“It ultimately stems from people getting really excited and overextending themselves, and then you kind of see a crash, and then it kind of corrects to an equilibrium,” Ahmed said.

Even crypto analytics platform Glassnode said earlier this year, before Bitcoin set new highs in October, that Bitcoin’s price action still appeared to be tracking the historical halving pattern.

On Monday, crypto analyst Colin Talks Crypto said that the party may be over for Bitcoin’s price for now.

“Without a quick recovery in the next day or two, this suggests we’re entering a bear market/bigger corrective period,” Colin Talks Crypto said.

Ciaran Lyons

Gaming scams ‘red flags’, Axie evolves, Wall Street Games ‘addictive’: Web3 Gamer

Web3 Gamer: The red flags that indicate a fake blockchain game will rip you off, Axie Infinity evolves to Mementos, Wall Street Games review.

Read moreStablecoin for cyber-scammers launches, Sony L2 drama: Asia Express

Marketplace for cyber-scammers launches its own stablecoin, Sony L2 collides with reality, Lazarus stole $650M crypto in 2024. Asia Express.

Read moreWeb3 games shuttered, Axie Infinity founder warns more will ‘die’: Web3 Gamer