|

|

Su Zhu and Kyle Davies’ latest insolvency drama

OX.FUN, a memecoin exchange that emerged from the remnants of Open Exchange (OPNX), found itself at the center of insolvency rumors this week after freezing $1 million in user deposits.

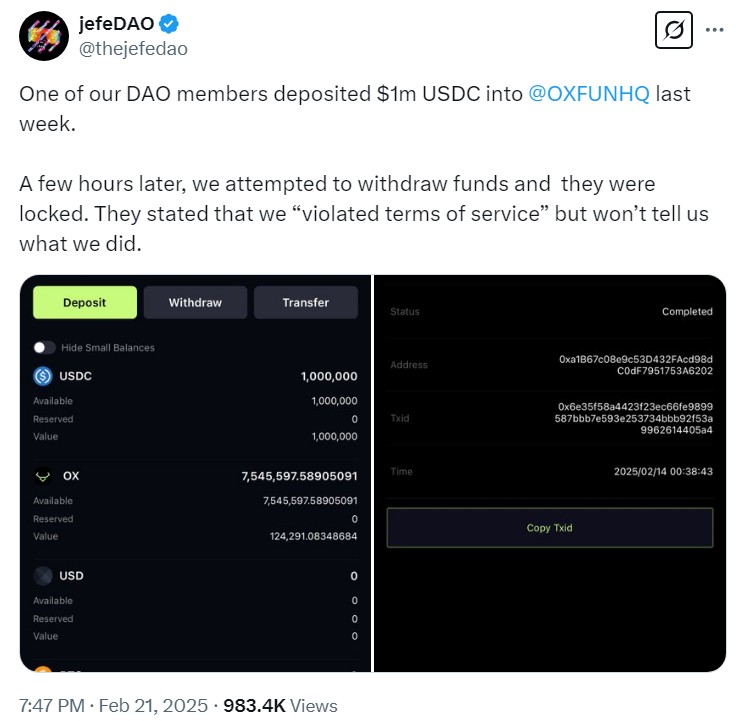

The controversy erupted on Feb. 21, when X user JefeDAO claimed on X that one of its members had deposited $1 million in USDC into OX.FUN, only to find the funds locked moments later. According to JefeDAO, the platform accused the user of violating its terms of service.

Nicolas Bayle, OX.FUN’s founder, pushed back against the allegations, stating that the user had attempted to exploit the platform. OX.FUN claimed the individual engaged in “market manipulation” to earn $120,000 in OX tokens, prompting the freeze. The exchange added that an agreement had been reached with JefeDAO, the account was reinstated and the original deposit would be refunded.

The incident triggered scrutiny of OX.FUN’s financial health, with Coinbase executive Conor Grogan noting that most of the exchange’s holdings appeared to be in its own tokens, a potential red flag for liquidity concerns. The situation worsened as OX tokens lost significant value amid the controversy, fueling speculation about the platform’s solvency.

OX.FUN dismissed the concerns, stating that tracked wallets did not reflect the full scope of the platform’s reserves. An OX.FUN team member told Magazine in a Telegram message that all user funds are backed 1:1 and said the exchange will launch a transparency dashboard “in the coming days.”

Adding to the scrutiny is OX.FUN’s ties to Kyle Davies and Su Zhu, the co-founders of the collapsed Singapore hedge fund Three Arrows Capital. The firm, once one of the largest in the crypto space, imploded in 2022 after making aggressive, leveraged bets that unraveled during the market downturn, leaving creditors billions of dollars in debt. After its collapse, Davies and Zhu launched OPNX, a trading platform for bankruptcy claims, which was later shut down and replaced by OX.FUN, where Davies and Zhu officially serve as advisers.

Bybit declares war against North Korean hackers

Bybit suffered the largest exploit in history on Feb. 21 by losing over $1.4 billion to North Korean hackers.

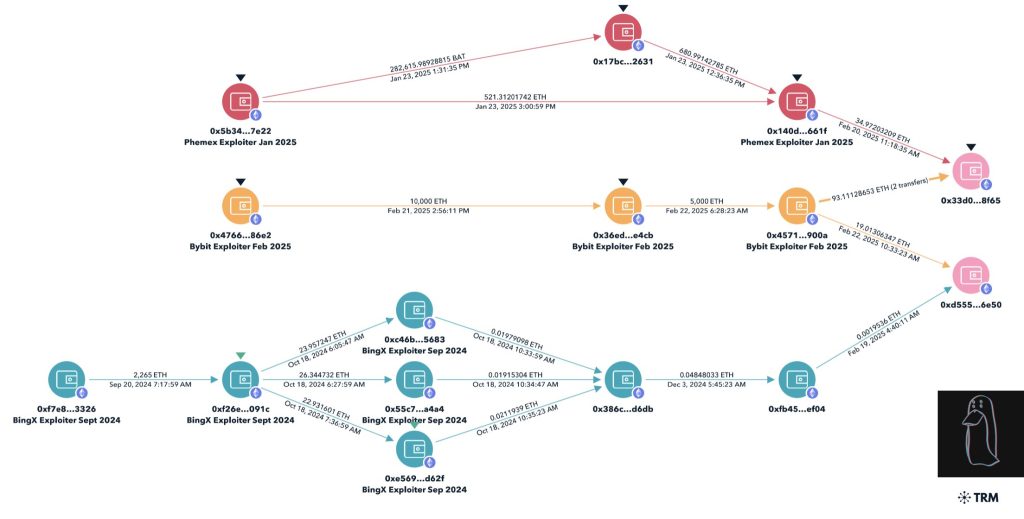

Crypto detective ZachXBT was the first to officially and publicly identify the hackers, claiming a bounty set by Arkham for providing conclusive evidence of their identity. He did so by linking a common address used in the Bybit exploit to previous hacks against Asia-based exchanges BingX and Phemex, both of which have also been attributed to the Lazarus Group. The Federal Bureau of Investigation later confirmed that the attack was conducted by Lazarus.

Bybit lost 401,000 Ether in the exploit, and the hackers quickly distributed the funds across multiple wallets, ultimately resulting in over 11,000 identified wallets, according to investigators at Elliptic.

A trait of North Korean hackers, aside from splitting funds into various wallets, is converting them into native assets like Ether before swapping them for Bitcoin. Crosschain swapping platform THORChain, which allows direct asset swaps such as Ether to Bitcoin, saw a massive increase in swap volume, surpassing $1 billion in less than 48 hours from Feb. 26.

After losing its funds to North Korea, Bybit announced a war against the hermit kingdom’s cyber unit and has obtained industry-wide support from partners and rivals in tracing and freezing funds.

However, eXch, a no-Know-Your-Customer swap exchange, has refused to freeze the illicit funds tied to the Bybit exploit. EXch denies laundering funds for North Korea.

South Korea’s largest exchange banned from accepting new users

South Korean regulators have dealt a crushing blow to the country’s largest cryptocurrency exchange, Upbit, imposing a three-month business suspension and executive dismissals.

On Feb. 25, the Financial Intelligence Unit announced disciplinary measures against Upbit and its executives for breaching the Act on Reporting and Using Specified Financial Transaction Information.

The sanctions effectively freeze Upbit’s ability to process cryptocurrency deposits and withdrawals for new customers for three months. Nine executives were disciplined, including CEO Lee Seok-woo, who received a formal warning, and the company’s compliance officer, who was fired outright — marking the first time a compliance officer at a South Korean crypto exchange has been ousted by regulators.

Authorities accused Upbit of flouting repeated warnings to engage in approximately 45,000 transactions with unregistered overseas exchanges. Regulators also found failures in customer verification, allowing unchecked trades despite strict financial compliance requirements.

Despite overseeing these violations, Seok-woo received only a slap on the wrist, with regulators citing his role as a supervisor rather than a direct participant in misconduct.

While the penalties are among the harshest ever levied against a South Korean crypto firm, Upbit downplayed their significance, insisting that trading services, fiat deposits and crypto exchanges will remain unaffected.

Speaking to local reporters, Upbit said the exchange is weighing all options, including legal avenues, to challenge the sanctions.

Vietnam rejects sandbox proposal for crypto payments

Vietnam’s Ministry of Finance (MoF) has rejected a proposal to introduce crypto transactions in the country’s upcoming financial centers, citing concerns over financial security and regulatory gaps, the state media Hanoi Times reported.

The decision is a setback for efforts to position Ho Chi Minh City and Danang as fintech hubs, as the government remains cautious about the risks associated with cryptocurrencies and digital assets, which remain unregulated in Vietnam.

Vietnam’s Ministry of Planning and Investment proposed the launch of a regulatory sandbox allowing digital transactions in the country’s new financial centers, set to begin on July 1, 2026.

However, the MoF has opposed the timeline, stating that without a legal framework governing digital assets, such transactions pose significant risks. Officials reportedly stressed that laws covering issuance, trading, service licensing and cybersecurity must be in place before allowing digital assets into Vietnam’s financial system.

The ministry urged other regulatory agencies, including the State Bank of Vietnam, to weigh in on the matter, as the potential use of digital currencies for payments falls under the central bank’s jurisdiction.

The MoF has also recommended that the government take direct control over any pilot program and remove the July 1, 2026 start date from the proposal.

Yohan Yun

Dogecoin flips Porsche, trader turns $160 into $5.6M, and more: Hodler’s Digest, Nov. 24 – 30

Dogecoin has surpassed the market capitalization of Porsche, a memecoin trader turned a $160 investment into millions: Hodler’s Digest

Read moreSEC drops Ether probe but still seeks billions in penalties from Ripple: Hodler’s Digest, June 16-22

The U.S. Securities and Exchange Commission has dropped its case against Ether. However, in another crypto case, the regulator still demands billions in penalties from Ripple.

Read moreIronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye