New Year’s fireworks spark over Neo co-founders battle

Neo co-founders Erik Zhang and Da Hongfei clashed on New Year’s Eve in a heated public exchange, accusing each other of mismanaging the blockchain’s treasury and misrepresenting years of internal governance decisions.

Neo is a long-running smart contract network founded in 2014 that rose to prominence during the 2017 bull market, when it was widely dubbed “China’s Ethereum.” The nickname reflected its early focus on smart contracts and regulatory-friendly design, similar in ambition to Ethereum but marketed as a domestic alternative for China’s tech ecosystem.

Zhang said he originally stepped away from Neo leadership after Da argued that joint oversight of the foundation was slowing the project.

“Either you step away, or I do. I’m fine with either outcome,” Zhang claimed Da told him in a private meeting. “Acting in what I thought was Neo’s best interest, I agreed on the spot that I would step aside.”

Zhang said the decision was not neutral. He claimed Da began developing a separate public blockchain project and said his removal “eliminated internal checks, making it possible to leverage Neo’s resources while building a separate, personally controlled project that directly competes with Neo.” He called it “a fundamental conflict of interest” and said he returned to demand “full, verifiable financial disclosure of [Neo Foundation’s] assets.”

Da rejected Zhang’s account outright. “False,” he wrote, saying the dispute stemmed from years of delayed efforts to secure the treasury.

“A blockchain project’s treasury should be secured by multisig, not by one man after years of launching. It is not negotiable,” Da said, accusing Zhang of intentionally stalling the handover.

Zhang claimed “the vast majority of Neo’s assets” beyond NEO and GAS had been under Da’s sole control for years. Da responded that “NEO [and] GAS were always the super majority of [Neo Foundation’s] assets,” and then accused Zhang of “lying and fabricating facts” and pointed to an upcoming financial report.

Neo Foundation distanced itself from the public kerfuffle, stating that the disputes will not affect its operations. It added that financial reports will be released in the first quarter.

Asia’s major markets are warming up to crypto ETFs

Japan sent a clear signal that cryptocurrency exchange-traded funds (ETFs) are moving closer to the regulatory mainstream.

Finance Minister Satsuki Katayama said in her speech at the New Year opening ceremony on Monday — locally known as the “daihakkai”— that 2026 marks a turning point for digital assets, and the first year of “full-scale” digitalization.

“To ensure citizens benefit from digital and blockchain-based assets, the role of exchanges and market infrastructure will be essential,” she said, according to a machine translation. “In the US, crypto assets are increasingly used via ETFs as inflation hedges, and Japan must also pursue advanced fintech initiatives.”

Japan’s messaging and recent developments in South Korea suggest that Asia’s largest economies are warming to crypto ETFs even as formal approvals lag behind demand.

On Friday, Korea Exchange chairman Jeong Eun-bo said that the exchange is operationally ready to list crypto ETFs and derivatives, despite regulators still debating whether digital assets qualify as eligible underlying securities.

Japan’s regulatory position is already shifting. Crypto assets have been regulated under payment and custody frameworks rather than securities law, limiting their eligibility as ETF underlyings. That is set to change as Japanese regulators are preparing to reclassify crypto as a financial product under securities legislation.

Progress has been more concrete elsewhere in Asia. Hong Kong approved spot Bitcoin and Ether ETFs in 2024, allowing products listed on the Hong Kong Exchanges and Clearing to begin trading, albeit with modest inflows compared with US counterparts.

Vietnam approves USDT conversion pilot

Vietnamese authorities in Da Nang city have reportedly approved a pilot allowing a local company to convert USDT stablecoins into Vietnamese dong and back.

This is Vietnam’s first licensed test of a non-custodial digital asset-to-fiat conversion model as the country brings new crypto regulations into force in 2026, according to state-affiliated media Hà Nội Mới.

The Da Nang City People’s Committee authorized Dragon Lab JSC to deploy its solution, which intermediates USDT and VND conversions without taking custody of user funds. The trial will run through Dec. 17, 2028, and will be conducted under regulatory supervision at three designated locations in the city.

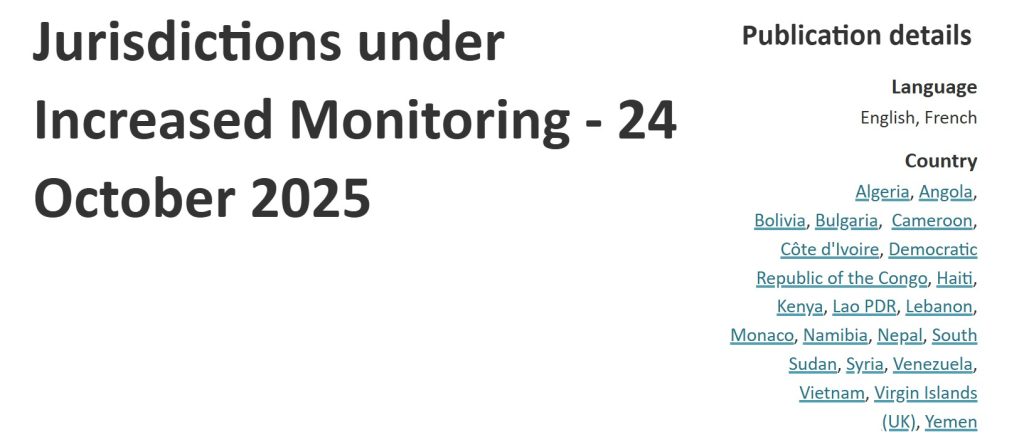

Vietnam’s “Law on the Digital Technology Industry” came into effect on New Year’s Day to establish a legal framework for crypto assets, licensing and regulatory sandboxes. The reforms form part of Vietnam’s broader effort to strengthen Anti-Money Laundering and Combating the Financing of Terrorism controls after the country was placed on the Financial Action Task Force (FATF) grey list in June 2023.

The FATF grey listing often signals deficiencies in a country’s financial crime controls and can raise compliance costs for banks, investors and international counterparties. Countries on the list face increased scrutiny from global financial institutions, which can restrict access to capital and deter foreign investment.

In a June 2025 recommendation, the FATF urged jurisdictions to accelerate enforcement of its crypto standards, warning that stablecoins now account for most illicit onchain activity. The FATF said jurisdictions continue to struggle with licensing, supervision and identifying crypto service providers, even as criminal use of stablecoins, fraud and cross-border laundering rises.

Indonesia kickstarts Asia’s crypto tax changes

Indonesia is set to become one of the first Asian jurisdictions to implement the Crypto-Asset Reporting Framework (CARF), allowing the automatic exchange of cryptocurrency and e-wallet data with tax authorities from 2027, covering the 2026 tax year.

New regulations from the Ministry of Finance expands Indonesia’s financial information reporting regime to include payment service providers, e-wallet operators and crypto service providers.

Payment service providers — including non-bank entities — are treated as deposit-taking institutions when they manage electronic money. That means e-wallet accounts and transaction data fall within the scope of information reportable to the tax authorities.

Cryptocurrencies are also brought within the reporting perimeter, with exchanges and other service providers required to disclose relevant financial information. The regulation authorizes the taxman to access data reported under CARF.

Indonesia is among a group of 48 jurisdictions committed to conducting their first CARF exchanges by 2027, according to the OECD’s latest commitment list. In Southeast Asia, Indonesia is moving ahead of peers, such as Singapore, Malaysia, Thailand and Hong Kong, which have indicated plans to begin CARF exchanges from 2028.

CARF extends cross-border tax transparency by requiring jurisdictions to collect and exchange information on crypto transactions. The framework was developed to address gaps in reporting created by the rapid growth of digital assets and electronic payment platforms.

Yohan Yun

XRP ETF pump ‘disappointment,’ Bitcoin to see out 2025 at $173K: Trade Secrets

XRP is more likely to see profit taking than a price surge, while Polymarket odds favor SOL, BTC and ETH hitting new highs this year.

Read moreAltcoin season 2025 is almost here… but the rules have changed

Altcoin season may finally upon us — but it’s not the altseason you remember. Wall Street money and infinite memecoins have changed the game.

Read moreBrandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets