Welcome to Trade Secrets. This month, we’re talking to top crypto analysts about where Bitcoin and other major cryptocurrencies are going in the year ahead and checking the options data and prediction markets.

The Bulls

Bag check: Dogecoin, Solana

Dogecoin may pump now that Elon Musk has more time on his hands: Santiment

Santiment analyst Maksim Balashhevich says now that Elon Musk is no longer working for the White House, he has time for more pro-Dogecoin antics, meaning another price rally could be on the horizon.

The fact that Musk and Trump are now fighting opens up the potential for Musk to return to his “old crypto playbook,” says Balashhevich.

“Musk might turn back to Dogecoin to score a public ‘win’ and restore some credibility.”

His “actionable insight” is for traders to monitor Dogecoin’s social volume. “If discussions around the coin remain low for a few more days, it could create the perfect setup for a pump should Musk decide to post about it,” he says.

Dogecoin has been closely tied to Musk’s antics over the years, with many tweets from the erratic Tesla boss leading to sudden pumps — so much so that he had a lawsuit against him.

Dogecoin surged 196% last November, following Trump’s presidential election victory and a broader upswing in the crypto market. Many attribute that rally to the excitement around Musk being appointed to lead the very conveniently named Department of Government Efficiency (DOGE).

Dogecoin has since lost most of Trump’s post-election gains as public opinion turned against the DOGE agency, trading at $0.1935 at the time of publication, according to CoinMarketCap data.

Solana could see $300 price tag before year-end: 21Shares

Solana has dropped nearly 13% over the past month and is holding onto the $160 mark tightly. With memecoin season nowhere in sight, what near-term catalysts, if any, can it count on?

21Shares crypto research strategist Matt Mena brushes off the short-term price pain and forecasts a small rally soon ahead of Solana’s price doubling by year’s end.

“In the near term, a clean break above the $180 resistance level could open the door for my near-to-medium term $200 target,” Mena tells Magazine.

“I see Solana entering price discovery and pushing above $300 by year-end,” he adds, citing the highly anticipated but much-delayed Firedancer upgrade, which is expected sometime in 2025, and the global rollout of the Solana Seeker phone starting in August.

“I’m bullish on Solana because it’s built for scale and retail,” he adds.

Mena cites the network’s low fees and the upcoming upgrades as key reasons for the firm’s conviction. He says these upgrades are anticipated to increase transaction speeds by 10 to 100 times, significantly improving the network scalability. He added:

“Solana is becoming the default chain for consumer-facing crypto apps.”

“It’s ideal for retail-driven use cases like payments, gaming, DePIN, and onchain social – areas where speed and cost matter most,” he says.

The Bears

Bag check: Bitcoin, Ethereum

Bitcoin may head back to $88K before ‘next leg up’

Bitcoin reached the current all-time high of $111,970 back on May 22, leaving many traders on the edge of their seats, hoping for a price reclaim and even higher gains. However one crypto analyst warns the pain might not be over yet.

Despite Bitcoin approaching its all-time high again, hovering around $109,000, Ledn’s chief investment officer, John Glover, tells Magazine he believes it could still drop below $100,000 in the near future.

“I don’t believe that this corrective move lower has completed yet,” Glover says.

Glover speculates that the Bitcoin pullback “will complete” in the $88,000 to $93,000 range before the next upswing.

He foresees the “corrective move” finishing sometime in the mid-to-late summer, followed by an “impulsive wave” higher.

He doesn’t rule out a possible retest of Bitcoin’s previous all-time high near $74,500 in an extremely bearish scenario. However, his longer-term outlook is more optimistic, with expectations for the price to reach around $136,000 by year-end.

Ethereum to fall short of $3K mark for now?

Nansen principal research analyst Aurelie Barthere tells Magazine that Ether will probably top out soon and may fall short of reclaiming the long-awaited $3,000.

Ethereum is trading at $2,691, up 2.65% over the past seven days, according to CoinMarketCap data. Barthere forecasts it may only rise a few hundred dollars higher.

In her view, the best-case scenario is Ether at its May high of $2,700, but warns the level might also mark a local top.

“It looks like this price cap will persist this summer, unless we get very bullish news on the tariff negotiation front. Next support for ETH is 2,300,” Barthere says.

“Some fundamental positive drivers for ETH include the latest SEC guidance on staking, which stipulates the legal framework for staking,” she adds.

Many industry experts believe staking is the key missing feature that would make US-based spot Ether ETFs far more appealing to retail investors.

What the derivatives markets are saying…

Onchain options protocol Derive founder Nick Forster tells Magazine that futures traders are pricing in a 10% chance of Bitcoin topping $120,000 by the end of September. There’s also a 10% chance of Bitcoin ending up below $92,000 over the same period.

Forster says that Bitcoin price consolidation seems like the most “likely scenario” in the near term. “Derivatives market makers are positioned in a way that will require them to sell BTC as the spot price rises, which could limit any potential rallies,” he says.

Forster says the narrative could soon shift toward Ether and stablecoins in the short term, following Circle’s successful June 5 IPO and a 15-day inflow streak into spot Ether ETFs.

However, the derivatives market data on Ether’s spot price is slightly more bearish than Bitcoin’s.

There’s an 11% chance it will surpass $3,200 by the end of September, and a 21% chance it will fall below $2,100 over the same period.

Sentiment: Santiment says retail traders are coming back, but is that a good thing?

Crypto sentiment platform Santiment has spotted a clear trend of retail traders buying back in since Bitcoin reclaimed the psychological $100,000 mark, after spending three months below six figures.

But the firm says that isn’t necessarily bullish.

“Small wallets, holding up to 1 BTC, have been accumulating aggressively,” Santiment said on June 6.

“Since May 22, these retail holders have added nearly 33,000 BTC to their balance,” Santiment said, adding it views this “as a classic counter-indicator.”

“Historically, when the ‘small fish’ buy with confidence, it often signals that whales are preparing to sell into that liquidity,” the firm said.

“This retail FOMO is a significant warning sign that a local top could be forming.”

Fineqia senior associate Matteo Greco tells Magazine that the market appears “evenly balanced” and there’s no clear consensus on what lies ahead.

“We’ll likely need to see more decisive price action, along with clarity on external factors, before a definitive trend emerges and expectations are firmly set.”

Meanwhile, other sentiment indicators signal that market sentiment is healthy, but very Bitcoin-dominated.

The Crypto Fear & Greed Index, which gauges overall market sentiment, currently shows a “Greed” score of 62, bouncing back after recently dipping into “Neutral” territory amid Bitcoin retracing from its May $111,970 all-time highs.

CoinMarketCap’s Altcoin Index, which compares the performance of the top 100 altcoins relative to Bitcoin over the past 90 days, suggests that the market is heavily favoring Bitcoin, with a score of 26/100. Bitcoin dominance is 64.59%, according to TradingView data.

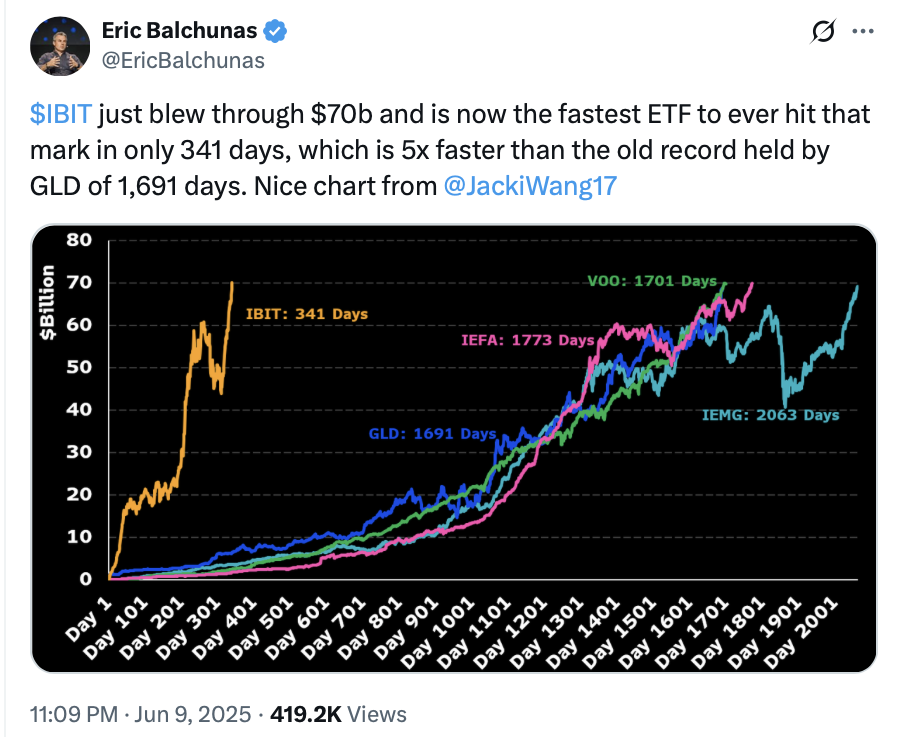

What the prediction markets are saying…

Prediction markets suggest punters are confident Bitcoin will reach new highs by year-end, but that same conviction isn’t reflected in bets on Solana or XRP.

Bitcoin has an 82% chance of breaking its current all-time high of $111,970 by July 1, according to crypto prediction platform Polymarket.

The odds of other major cryptocurrencies reaching new all-time highs by the end of the year have declined since the May Trade Secrets column.

Solana now has just a 27% chance of surpassing its previous peak of $293 by the end of 2025, down 16% from its odds last month, following a nearly 13% drop in its price.

XRP’s odds of hitting a new all-time high by year-end have also slipped to 38%, down 11% from its odds last month. XRP, which has yet to top its 2018 high of $3.40, saw a 2.46% price decline over the same period.

Ethereum has 24% odds of breaking its all-time high of $4,878, down 2% from its odds last month.

Ciaran Lyons

Venezuela shuts down Petro, SEC’s X account hacked, Bitcoin ETFs go live: Hodler’s Digest, Jan. 7-13

Bitcoin ETFs approved and trading in the US; SEC’s X account is hacked, causing havoc in markets; and Venezuela discontinues its national cryptocurrency, Petro.

Read moreDanger signs for Bitcoin as retail abandons it to institutions: Sky Wee

Sky Wee, an influencer with 4M followers, worries about Bitcoin’s future: “The real risk isn’t institutions buying, it’s retail not buying.”

Read moreWeb3 games shuttered, Axie Infinity founder warns more will ‘die’: Web3 Gamer