Robbie Heeger’s Endaoment has facilitated the donation of over $30 million of cryptocurrency to 243 different charities. These donations come from altruistic cryptocurrency investors who are also partly motivated by reducing their tax burdens to Uncle Sam and keeping more of their profits.

Born in Silicon Valley, Heeger, now in his early 30’s, was exposed to entrepreneurship from a young age. Though he initially worked in big tech, he soon became so enthralled with blockchain that he dropped everything to pursue his new passion in 2018. This led him to create Endaoment, which he calls the first regulatory-compliant nonprofit built entirely on the Ethereum blockchain. The project allows anyone to donate one of over 150 cryptocurrencies to a charity of their choice and, in doing so, reduce their tax liabilities.

Endaoment represents the latest generation of blockchain giving — but it is not the first. In 2017, a mysterious figure calling themselves Pine anonymously donated 5057 Bitcoin, worth $55 million at the time, to a collection of over 60 charities.

These donations not only encouraged major charities to accept cryptocurrency contributions for the first time but also served to counteract the perception of Bitcoin being primarily used in dishonest or criminal activities. While the Pineapple Fund helped legitimize cryptocurrency as a medium of charity, it was by no means the first. As early as 2011, Bruno Kučinskasin created Bitcoin 100, an initiative to donate Bitcoin to charities that would openly accept BTC.

Despite many charities‘ early exposure to cryptocurrency, few have continued to receive substantial donations on the blockchain and many even removed such donation options from their websites. The reason was simple on one level and yet complex by nature — taxes.

Endaoment

Upon graduating from university in 2012, Heeger accepted a full-time position with Apple where he first worked as a content publishing quality assurance engineer before becoming a manager of production operations. As his career progressed, his fascination with blockchain technology grew and in 2018, he “left Apple with this understanding that crypto was not just something that I could be tangentially interested in anymore — it was consuming.” Despite his experience at a major tech company, he saw himself as technically weak and took boot camp-style classes in solidity coding and blockchain web development.

“I started brainstorming ways that I could take this new skill set and try and build something that would funnel crypto capital into non-profit organizations that otherwise would have had very little exposure to crypto,” Heeger recounts of his early days. One of his initial ideas was to create a “media chain” by which to verify news content and make it resistant to censorship.

The brainstorming paid off, as he recalled how he had made it a habit to give away a portion of his Apple stock to a donor-advised fund each year because he “had stock that had tax obligations on it and I wanted to give that stock away without having to sell it first.” Charity can, of course, be more than simply selfless giving, as strategic donations can often allow for both individuals and businesses to reduce their tax burdens. While selling AAPL stock before donating it would have incurred additional capital gains taxes, giving the stock to a donor-advised fund allowed him to receive tax benefits for the entire value of the stock without incurring capital gains taxes, as charitable donor-advised funds are not liable to tax.

“I had crypto that had appreciated significantly and I didn‘t want to sell it first in order to donate it. I thought ‘wouldn‘t it be cool if there was a donor-advised fund that took crypto’ and that was the seed that became Endaoment.

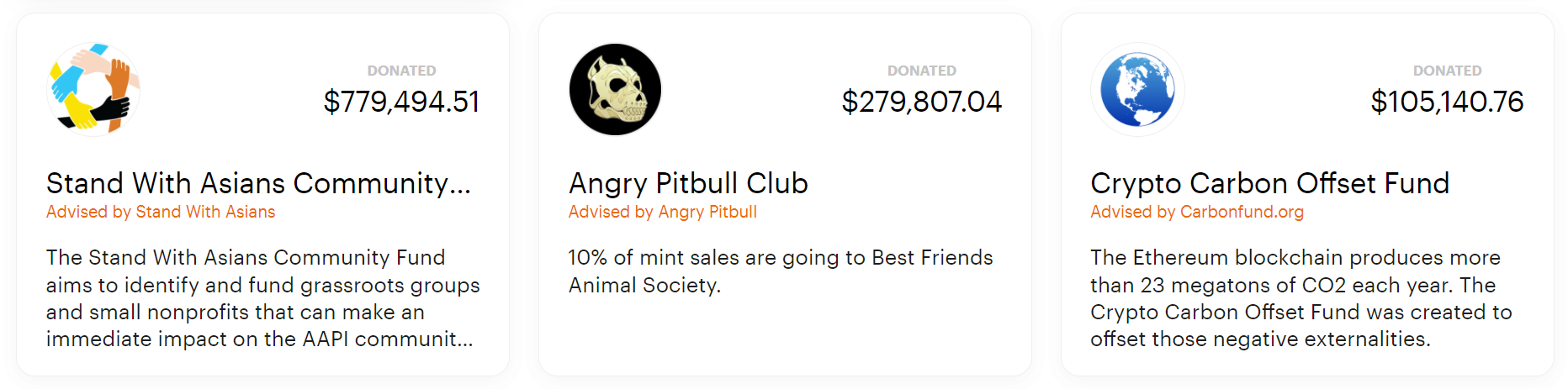

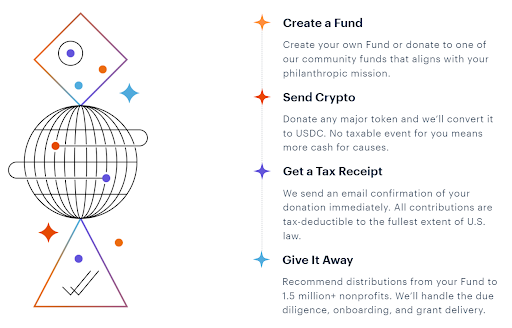

Heeger, now in his early 30’s, founded Endaoment in March 2019. Its core function is to provide a tax receipt in exchange for a donation of cryptocurrency. As a donor-advised fund, those making donations receive “advisory privileges” which means that they can suggest where they would like the proceeds of their cryptocurrency to be donated. In practice, this means that 99% of the time, funds go to the donor’s desired U.S. charity of which Heeger says there are about 1.5 million. The 1% of times when the funds do not reach the donor’s first choice of destination include situations where the grant recommendation “is to a hate group or an organization that‘s not in good standing with the Internal Revenue Service, or one that presents some conflict of interest for the organization,” Heeger explains.

“Give us your crypto and we will give you a tax receipt that says you donated it to a 501C3 tax-exempt non-profit public benefit corporation called Endaoment,” he clarifies regarding the business model.

Thank you for the bids on Grifter #659. One of three rats in the collection and without doubt the most pretty.

All proceeds will go to the Grifter Fund in collaboration with @endaomentdotorg 🙏

Check out all the auctions: https://t.co/hpSUANo3Dl pic.twitter.com/OJ5Ktei1QB— XCOPY 🏴 (@XCOPYART) December 23, 2021

Here’s how it works in numbers

Suppose Fred bought 1000 ETH at $3 for $3,000. At $3,000 per ETH, he now has $3 million in unrealized capital gains. Presuming a 33.33% capital gains tax, he would owe the government about $1 million upon sale, being left with $2 million for himself. Alternatively, he could choose to donate 250 ETH to Endaoment, which would issue him a tax receipt for the equivalent of the $750,000 donation, allowing him to deduct that $750,000 from the remaining $2.25 million, so that he only owed taxes on $1.5 million. The $750,000 donation brought Fred’s capital gains tax from $1 million to $0.5 million, while allowing him to donate $750,000 to the charity of his choice.

The talk of the IRS reveals a bottleneck: In order to maintain its status as a U.S. tax-exempt public interest corporation, Endaoment can only issue grants to 501C3 charities registered with U.S. authorities. This means that while many local charities outside the U.S. would not be valid recipients of donations, various international causes can still be targeted as many of the charities act globally.

“We‘ve done a lot of work in Sub-Saharan Africa and Afghan refugee relief, and donations toorganizationsthat do work in Europe and all over the world that just have US 501C3 entities that they use as fundraising vehicles for donors in the U.S.,” Heeger clarifies.

Though Heeger notes that he “cannot solicit services to people outside of the U.S.,” people outside the United States have used the Endaoment software to make crypto donations for which they receive U.S. tax receipts just as any American would. Success in getting tax deductions in such international cases is far from guaranteed, and Heeger notes that not all countries issue tax deductions on the basis of charitable giving. Many users have asked about the possibility of creating tax receipts that meet the requirements of various governments, as the tax systems of many countries consider self-directed donations as societally desirable and therefore encourage them by granting tax reductions based on registered donations.

“We‘ve seen people in Japan, in Australia, in the U.K. and in France come and use the site in order to effect impact — They have taken on the burden of figuring out how they prove the deductibility with their local regulators themselves.

Heeger sees many opportunities for future expansion including to charities in other countries which he believes would upgrade the number of options from 2.5 to over 7 million charitable organizations. It is clear that his mind has never left Silicon Valley, as he characterizes the project as a “minimum viable product that supports straightforward crypto giving of any crypto asset to any U.S. nonprofit as dollars.”

Born in Silicon Valley

Heeger grew up in California’s Palo Alto in the early 2000s, which he describes as an intense and highly competitive environment where various parents of his classmates would “show up on keynotes for the iPhone or some Google service.” The setting made for an environment with lots of access to and encouragement to use and experiment with new technologies, with tech companies often using the schools he went to as testing grounds for new products.

Driven by a passion for storytelling, in 2008, Heeger began studies in broadcast and digital journalism at the University of Southern California. He specialized in publishing technology, inspired by what he saw as a “disruption of the legacy media institutions by the internet” causing a change in the way people got information. He also grew interested in ethics such as the need to balance profitability and the journalistic duty of honest reporting. Soon, he found himself running iTunes’ social media channels as an Apple intern.

“I really loved the triangle of business, technology and ethics, and having to try and find balance between those three key drivers — journalism had that in spades.

Throughout his studies, he worked for the campus TV news station, where he eventually oversaw 25 reporters and other staff as a multimedia director. In 2010, Heeger had “a real eye-opener” when he traveled to Tanzania to volunteer as an English teacher at a rural town on the foot of Mt. Kilimanjaro through an organization called Cross-Cultural Solutions. Though he looked for teaching methods that would help the children gear up for their future in a competitive world, he saw that providing a Palo Alto-style education was a “challenge when you‘re trying to do work in a space that‘s chronically underfunded.”

2021 was a breakout year for @endaomentdotorg, from major gifts 💰, to #NFT powered #philanthropy 🖼, to fiscal sponsorships 📜 and beyond! 🚀

Learn about the community behind nearly $30 million in #CryptoPhilanthropy in our full Annual Impact Report: https://t.co/OYAKGgFc3v pic.twitter.com/rd8OD3Nxuk

— Endaoment (@endaomentdotorg) January 19, 2022

Anonymous donors

One case in which Endaoment is unable to issue tax receipts is when the donor is fully anonymous. Though anonymous donations can be accepted and Heeger notes that many “religions will say that the anonymous giver is the most righteous kind of giver because they don‘t expect anything in return,” only a very small percentage of donors fit that category.

Heeger explains that there are various degrees of anonymity when it comes to donating such as whether the donor wants to be unknown to only the receiving charity or to Endaoment as well. When sending crypto from an address with an ENS name, for example, it may be easy for anyone tracking transactions to deduce who the donor is, though the receiving charity itself will not see such information. If funds are routed directly from an exchange, Heeger says that not even Endaoment has any way to figure out the identity of the donor. In such cases, he often checks with the organization to ensure that they are comfortable receiving anonymous money.

In one example of semi-anonymous giving, the developers of SushiSwap donated $1 million SUSHI, with each donation being labeled as being from the SushiSwap core developers rather than from any particular individual.

Journey to DAO

In the future, he says Endaoment will support complex investment strategies and international giving. These strategies would include the gauntlet of crypto-assets like NFT’s, vote-locked tokens and interest-bearing tokens. “You should be able to give whatever it is that you want to give and direct those proceeds to an issue that you care about,” he emphasizes.

What Endaoment is not yet, despite the name, is a DAO. That is meant to change soon, however, as Heeger’s plan is that “people who are actively advancing the mission of Endoament are rewarded with tokens that give them membership, interest and oversight power over the nonprofit entity itself.” This would make EnDAOment a decentralized autonomous organization, which comes with the Web3 dream of leveraging a community to make happen what no small centralized team could ever do.

Soon, Heeger imagines that it will be easy for anyone to become the next Pine, even on a much smaller budget, and create a fund through which they and others use to distribute their crypto wealth to charities around the world.

“We want to democratize those philontrophic tools and make them as easy as interacting with a DeFi Protocol or as easy as transacting using MetaMask.

Elias Ahonen

In crypto, no one cares who you are: Here’s why that’s a good thing

Autism will be redefined, criminals will be thwarted, and pseudo-anons will one day rule the world.

Read moreWe took an ETHSafari to see how crypto is working out in Africa

The ETHSafari crypto conference in Kenya is a world away from Token2049… and a completely different mindset.

Read moreChina’s 100K TPS blockchain, Japan’s Minna Bank eyes Solana: Asia Express