In recent months, a raft of alt-L1s joined Ethereum to become L2s, even as other projects on L2s switch back to the Ethereum mainnet.

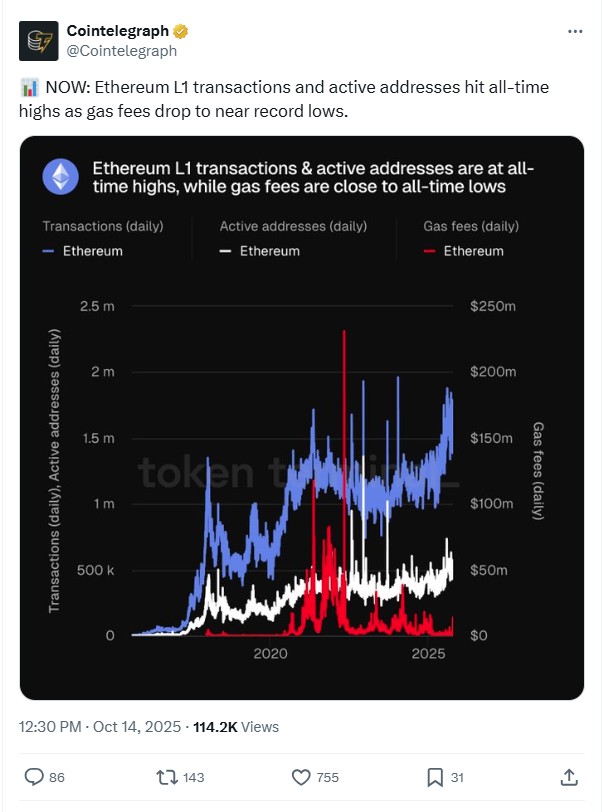

The Ethereum L1 is reasserting its claim to be the home of high-value DeFi — it has seven times more TVL than its nearest rival — while the L2 model offers millions in potential savings, along with network effects for alt-L1s that join the ecosystem.

Back in March, when bearishness around the “extractive” L2 roadmap was at its peak, mobile payments network Celo quietly closed down its validator network to become an L2. Now, it’s saving almost $7 million a year in operating costs.

In August, blockchain gaming L1 Ronin announced it was coming home to Ethereum in early 2026, five years after network congestion forced its popular game Axie Infinity off mainnet.

“Ethereum has largely delivered on the scaling roadmap,” says Jeffrey “Jiho” Zirlin, co-founder of Sky Mavis, which built both the game and alt-L1.

That same month, OG DeFi project Synthetix, which led the charge to Optimism in 2021, revealed it would shutter its L2 franchises to tap the enormous liquidity that refuses to budge from mainnet. It’s launching a Hyperliquid-style perp DEX with a flashy trading competition for high-profile influencers like Ansem and Degen Spartan.

In September, Aave announced a proposal to shutter half of its under-performing instances, which have spread out like McDonald’s across L2s and other chains like Avalanche, BNB Chain, Fantom and Harmony. Despite five years of expansion, 86% of Aave’s revenue is still generated on Ethereum’s L1.

And so far this month, Consensys founder Joe Lubin has confirmed that global banking alliance Swift is building its crypto payments system on the Linea L2, and Polkadot AI agent project Phala voted to become an L2 because that’s “where developer activity, liquidity, and tooling are strongest.”

The movement back to Ethereum reflects growing optimism that the scaling roadmap might actually work, especially now there’s a credible plan to scale the L1 using gas limit increases and ZK tech. DeFi projects can happily throw resources into building on the L1 without worrying that it will grind to a halt if activity increases.

“We believe that there’s now enough of a commitment and enough action that we’ve seen from the Foundation and developers to scale the L1,” says lead engineer Ben Celermajer of Syntetix’s decision to return.

Projects with different needs can take advantage of cheap security and higher throughput on the L2s, which will get up to an 8X data capacity increase in 2026.

It’s not all one-way traffic, though: fantasy sports NFT project Sorare saw a big uptick in volume after jumping ship to Solana this month, and Circle and Stripe recently announced competing L1s, Arc and Tempo.

But Ethereum fans take comfort in the fact that those stablecoin L1s are EVM-compatible.

“I believe that they’ll eventually become an L2,” says Zirlin. “Maybe at the beginning, kind of like us, they want the flexibility in some ways to do what they want, and eventually they’ll come home to Ethereum.

“All EVM L1s are future L2s,” he says.

Synthetix returns to Ethereum mainnet

After spending a couple of years in the wilderness, Synthetix is already reaping the rewards of coming home to mainnet, with a God candle earlier this week.

Its new Central Limit Order Book (CLOB) perp DEX hopes to attract attention with its trading comp this month, and aims to attract traders with size when it launches at the end of next month.

It’s yet another sharp turn for Synthetix, which began life as a stablecoin project, pivoted to synthetic assets to ride the yield farming boom above $30 in 2021, before reinventing itself as an AMM-style perp DEX in 2023.

For most of the past year, the unwinding of its old staking system has seen its stablecoin, SUSD, off the peg, but Synthetix v4 has recruited 80% new team members to start afresh.

Founder Kain Warwick, who returned to lead the project again earlier this year, admits that “Synthetix lost its way” for several reasons, but says that Layer L2s ultimately constrained its growth.

The leap to Optimism in 2021 was unavoidable, as gas fees for even claiming weekly rewards were around $100 on mainnet. It later set up shop on Arbitrum and Base and started work on an app chain called SNAXchain.

“That path was perps everywhere,” Celermajer tells Magazine during an interview at Token2049. “They were going to launch on Solana and Sui too.”

By the middle of last year, it was clear the project was flailing. Celermajer was brought on board to help right the ship. He says part of the problem is that what liquidity there is on L2s is mercenary and highly mobile, “it just goes wherever the next incentive is.”

But the big issue was that whales never truly embraced L2s, possibly due to the inherent risk of locking funds in bridges that are like honeypots for hackers. Ethereum L1 accounts for 60% of the entire TVL in crypto, but the leading L2 Base has just 3.5%.

”There’s no question that there are large market makers, liquidity providers, whales, who were happy to dabble with L2s, but didn’t wholesale go [over to L2s],” Warwick explains. He was one of them.

“At no point did I ever move more than 5% of my Synthetix onto Optimism…. I could afford the fees, [but] because of security. There’s a whole bunch of reasons.”

But many projects with lower-value transactions and higher throughput did shift to L2s, freeing up space.

“One of the choices of going with this L2-centric roadmap is it’s actually opened up a ton of bandwidth on L1,” he says, adding, “The L1 has gotten better in the last five years. Proof-of-stake and larger block sizes — there’s a bunch of things that have improved.”

Average gas fees have been reduced on mainnet by 99% from the peak. The L1 gas limit (the amount of computation it can handle) is expected to increase to 60 million gas units per block around the time of December’s Fusaka upgrade “with the goal to increase this to around 100M some time after,” the Ethereum Foundation tells Magazine. That would equate to a maximum of 80 TPS (the current maximum is 40 TPS).

Synthetix plans to scale itself on mainnet

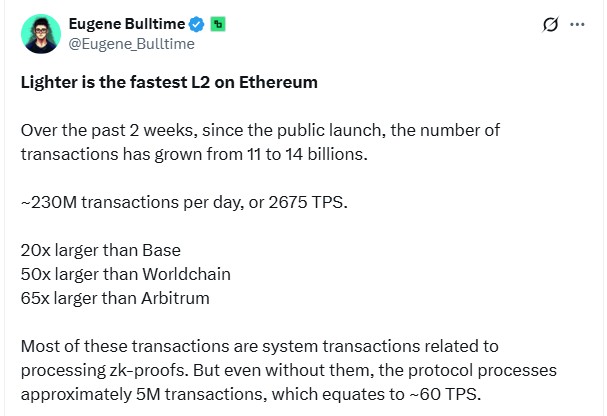

While that’s six times more throughput than DeFi Summer, it’s not enough to run a high-frequency CEX-style trading. Instead, Synthetix will run an offchain matching engine capable of 100,000 TPS. As a result, it will be closer to Trust Me Bro than trustless.

Celermajer argues that it’s impossible to run a high-frequency trading system on a genuinely decentralized network due to the latency of global consensus, so it’s a necessary compromise.

“Four years ago, when everyone was a decentralization maxi, I don’t think it would have flown, but we’re at a stage in the market where people are more willing to accept those trade-offs,” he says.

Warwick envisages a transition to an “Optimistic order book” which would essentially transform the app into something akin to its own rollup.

“Like in the optimistic rollup model, whereby you do all this stuff [process transactions] and then you post the state to blobs,” Celermajer explains.

Warwick says this could be achieved using TEEs. Another option would be to copy Lighter’s use of ZK-proofs to show that its offchain transactions were performed correctly.

It’s still highly speculative, but it’s possible that one day apps on mainnet could just scale themselves…

Aave’s Ethereum status: It’s complicated

Lending and borrowing protocol Aave is taking a more measured approach, scaling back instances on other chains without going all-in on L1.

In September, Aave Chan Initiative founder Marc Zeller detailed how its expansion strategy was being revised on the Aave governance forums. From 2021 onward, Aave planted its flag everywhere from Polygon to Arbitrum, Optimism, Base, Linea, ZKsync Era, Avalanche, BNB Chain, Fantom and Harmony.

Around half of all those instances are now unprofitable and face closure. However, since Zeller’s post, Aave has announced its integration with OKX’s X Layer L2 and Crypto.com’s Cronos Chain L2. It went live on Plasma, where it amassed a $6 billion TVL in just a few days.

Asked at Cointelegraph’s Longtitude event earlier this month if Aave would expand to Solana, founder Stani Kulechov said the project will go wherever the money and users are.

“Well, from Aave’s perspective, we want to see the technology everywhere there’s users and obviously we’ve started to build from Ethereum, and that’s where most of our activity is, but down the line, obviously, we want to support any technology and onchain stack that gets adoption and has a a user base and has potential for profitability.”

Ronin returns to Ethereum as an L2

Another project that left Ethereum due to mainnet congestion in 2021 was alt L1 Ronin. The move enabled it to scale Axie Infinity up to 2.8 million daily users during its 2022 peak. “Axie Infinity was the first game that basically hit exponential growth by migrating to a scaling solution,” says Zirlin.

It’s still a top title, generating $1.4 billion in the first half of the year. But bringing the game back to mainnet simply wasn’t an option.

“Ethereum mainnet is good for maybe DeFi and maybe some stablecoins, and some transfers, but gaming has pretty complex transactions that really require scalability,” he says.

Ronin now supports 100 games and attracts 350,000 daily active addresses and 800,000 monthly active addresses.

“Transaction activity on the chain is actually much higher than it was at the peak of the Axie boom,” Jiho says.

While a return to Ethereum was always on the cards, it’s only recently that Zirlin has had the confidence in the scaling roadmap to come home.

“You have the idealism of the Ethereum community versus the pragmatism, right? And I think we’re kind of in the middle. That’s why we initially chose to go with something that was just working. But over time, as Ethereum also made practical steps, we’re like, ‘Okay, we want to kind of meet in the middle here,’” he says.

Ronin’s relaunch as an Optmistic rollup (incorporating a zkEVM) in the Superchain in early 2026 will come shortly after the Fusaka upgrade starts to scale up blob capacity by a factor of eight. Data availability and cost have been the major limiting factors on the Ethereum ecosystem TPS. Last week, the ecosystem peaked at 2,835 TPS for the first time, and next year it’ll be able to do much more.

Running an L1 costs millions more than running an L2

There will still be faster and cheaper chains after the Fusaka upgrade, but there are huge savings to be made for any L1 that transforms into an L2.

Ecosystem analytics site GrowThePie co-founder Matthias Seidl (Matze) told The Edge Podcast last month that the savings add up to millions of dollars a year.

“By becoming an L2, Celo actually cut 99.8% of their security costs because now instead of having to pay like a set of 100 validators — I think it was like 110 validators they had in the end which each got like $59,000 per year for validating,” he said, whereas an L2 has to only pay a few bucks for settlement on the L1 and data blobs.

“It ends up being a 99.8% cut in their costs and bringing down their previous expenses of $6.9 million per year down to only like $13,000 or $13,200.”

Zirlin says running an Alt L1 network is “very complex and costly,” with $35 million paid out in staking rewards since 2023. Those funds will now be redirected toward developers who drive revenue to the chain and lifetime high-value users.

“You’re using your validator rewards to incentivize security, but if you can outsource that to Ethereum, you can now use the emissions to incentivize other things,” Zirlin explains.

Other benefits of becoming an Ethereum L2: Everyone likes you

There are other benefits to becoming an L2, including ensuring Ronin is “able to stay up to date with all of the latest EIPs that are integrated, and we wanted to benefit from the full security of Ethereum maintenance.”

Plus, they’ve been warmly welcomed back into the fold.

“I could definitely see more collaborations,” he says. “When you’re part of the Ethereum ecosystem, there’s certain people who wouldn’t message us or talk to us before, but now are suddenly ‘hey, we’re all kind of part of the same ecosystem’.”

Andrew Fenton

Brandt says Bitcoin yet to bottom, Polymarket sees hope: Trade Secrets