Bitcoin ETF blowup shortlists a handful of Hong Kong funds

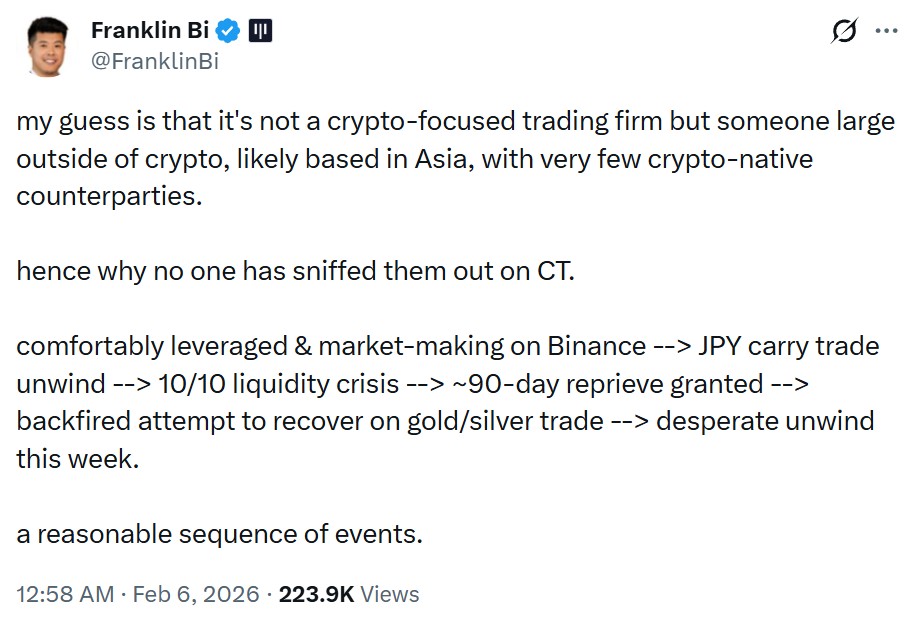

A popular theory explaining Bitcoin’s recent selloff points to an Asian fund whose leveraged spot Bitcoin exchange-traded fund (ETF) options trade blew up.

Parker White, chief of operations and investments at DeFi Development Corp, said in a viral tweet that a Hong Kong-based company is believed to have used cheap Japanese yen funding before being forced into liquidation across multiple markets.

BlackRock’s Bitcoin ETF (IBIT) posted a record $10 billion trading volume on Thursday, when Bitcoin slid to its lowest level of the week near $60,000. Liquidations on centralized cryptocurrency exchanges remained relatively muted despite the sell-off, which White said suggested stress from large IBIT holders.

White found that some Hong Kong funds hold the bulk of their assets in IBIT. Funds typically diversify holdings, while single-asset structures are often used to isolate margin risk so losses don’t contaminate other investments.

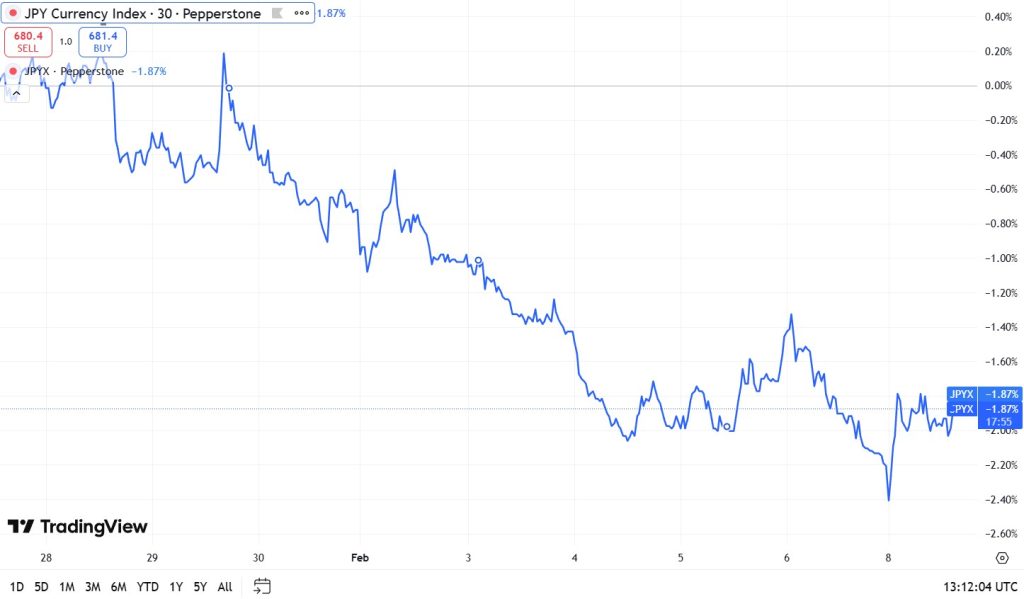

Based on that context, the theory holds that a fund borrowed cheap yen to buy IBIT options and bet on Bitcoin’s rebound. As losses mounted and funding conditions tightened, the position may have been forced to unwind.

The IBIT blowup hypothesis links the activity to a broader cross-asset margin unwind tied to yen-funded leverage, with silver — which also plunged on Thursday — cited as one example.

“We know that Asian traders, particularly in China, have been deeply involved in the Silver and Gold trade, White said. “We also know that the JPY carry trade has been unwinding at an increasingly rapid pace.”

White’s theory has been cited by media outlets and widely shared across Crypto Twitter, but it remains unproven. The industry will likely have to wait until May, when Form 13F filings for the first quarter are released, to determine whether any funds disclose significant changes in IBIT holdings.

Bithumb’s fat thumb sent more Bitcoin than it had

South Korean crypto exchange Bithumb is facing questions over so-called “phantom” Bitcoins after an administrative error distributed far more rewards to users than intended.

A Bithumb promotional campaign mistakenly sent more than 2,000 Bitcoin to each winner. In total, it mistakenly distributed roughly 620,000 Bitcoin, an amount worth nearly $42.5 billion at current prices.

Bithumb said it recovered 99.7% of those assets. However, some users managed to flip 1,788 Bitcoin before the exchange clawed them back.

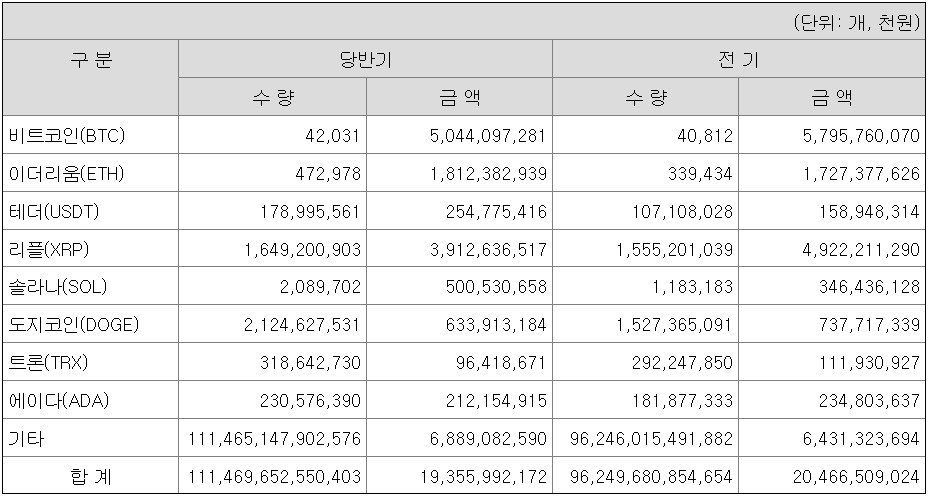

A more troubling issue has emerged beyond the scale of the error. In a mid-year filing submitted in August to the Financial Supervisory Service (FSS), Bithumb reported holding approximately 42,031 Bitcoin. That figure is about 15 times less than the amount distributed during the incident.

If the exchange did not accumulate 577,969 BTC after the filing, then Bithumb distributed more cryptocurrency to user accounts on its platform than it actually holds. Because some users were able to immediately sell the supposedly non-existent assets, the local industry has dubbed the incident Bithumb’s “phantom” Bitcoin case.

Under South Korea’s crypto user protection law, exchanges are required to hold the assets deposited by customers. FSS governor Lee Chan-jin said regulatory action may be possible under existing rules. The regulator has since launched on-site inspections following the incident.

The rise and fall of Ethereum whale Trend Research

Ethereum whale Trend Research has sold off all of its Ether, leaving just $10,000 in USDC across wallets tracked by Arkham.

As of last week’s Asia Express, Trend Research had already reduced its Ether exposure by 73,000 ETH, largely held as Aave wrapped Ether. Despite those sales, the firm still held 578,000 ETH as of last Monday. Over the week, Trend Research continued selling Ether to unwind leveraged positions. By Sunday, its Ether balance fell to zero.

Trend Research has been linked to Yi Lihua, also known as Jack Yi, the founder of Hong Kong-based crypto venture firm Liquid Capital. The firm first drew the attention of blockchain analysts in November after aggressively accumulating Ether. By the end of January, it held roughly 651,000 AWETH.

Yi built the position through leverage. He purchased Ether on centralized exchanges, deposited it into Aave as collateral and borrowed stablecoins, which were then used to buy additional ETH. When Ether prices declined alongside Bitcoin and the broader crypto market, Trend Research was forced to unwind its position to repay its loans.

While the firm no longer holds ETH or AWETH, a machine-translated post from Yi claimed that he believes crypto’s broader consensus remains intact.

“On the flip side, when crypto enters a bear market, it is often the best time to build positions, just as we benefited in the previous cycle by accumulating during the bear market,” Yi wrote.

“Pessimists are often right, but optimists win in the end,” he added.

Japan’s snap election landslide keeps crypto on track

Japan’s Lower House snap election on Sunday handed a two-thirds super-majority to the Liberal Democratic Party under Prime Minister Sanae Takaichi, reducing uncertainty around ongoing crypto policy discussions.

Those discussions include proposals to revise crypto tax treatment and to review whether digital assets should remain regulated under the Payment Services Act or transition to the Financial Instruments and Exchange Act.

The tax debate centers on how crypto gains are classified under the income tax system. Currently, most individual crypto gains are treated as miscellaneous income and taxed up to 55%. Lawmakers have been discussing whether crypto gains should instead be taxed under a separate flat-rate framework similar to securities, which are taxed at around 20%.

Japan’s tax discussions are tied to broader questions about how crypto should be legally categorized.

Moving crypto to the Financial Instruments and Exchange Act would place digital assets within the same legal framework that governs ETFs and other investment products, making crypto ETFs legally possible in Japan.

Japan’s government has also signaled interest in developing market infrastructure that could support such products if permitted. Finance Minister Satsuki Katayama said in her New Year speech that Japan should pursue blockchain-based fintech initiatives, like ETFs.

Yohan Yun

Blockchain’s next big breakthroughs: What to watch

Blockchain’s next big breaThe post-Bitcoin halving period brings new opportunities and challenges that will shape the future of decentralized technology and its influence on global markets.kthroughs

Read more6 Questions for Jennifer Wines of Fidelity Private Wealth Management

“Decentralization, to me, means the distribution of power. […] This ends up activating more people and potential than is possible with centralization.”

Read moreWeb3 games shuttered, Axie Infinity founder warns more will ‘die’: Web3 Gamer