XRP named Thailand’s top asset for nine straight months

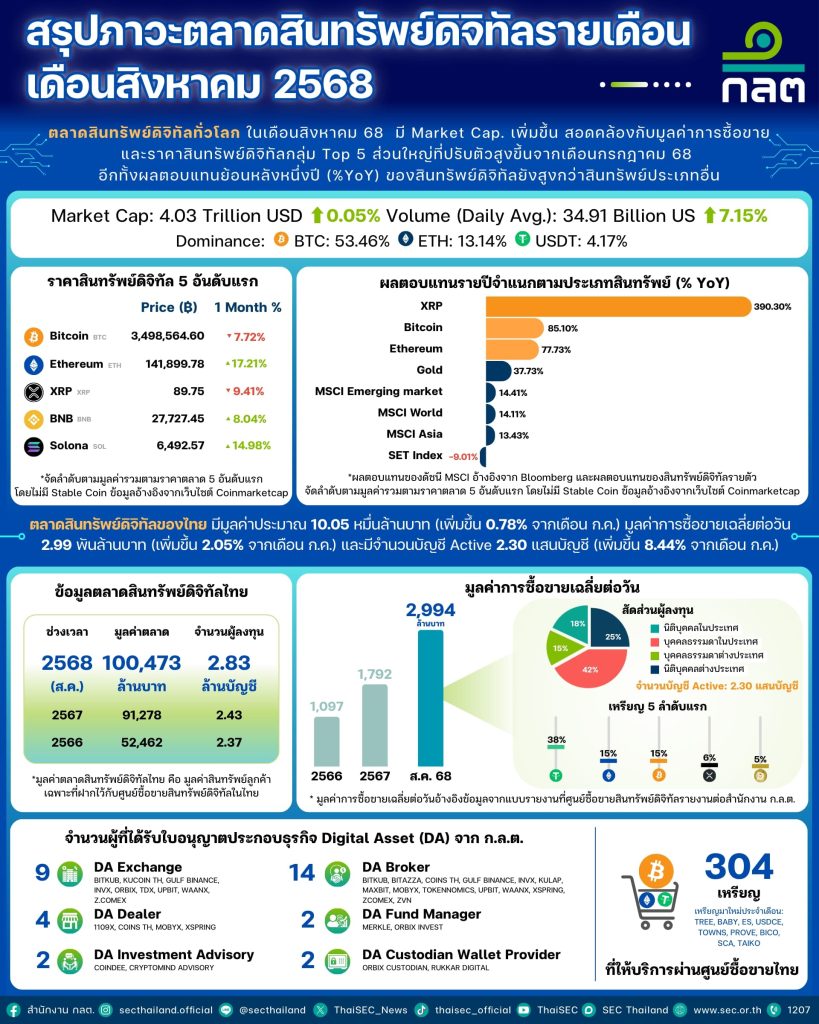

XRP delivered the strongest returns among all major asset classes in Thailand, soaring 390% year-on-year in August, according to the Thai Securities and Exchange Commission’s latest digital asset market report.

The XRP token has now topped the SEC’s performance rankings for nine consecutive months, outpacing gold, equities and other benchmarks listed in the regulator’s database. Solana was the last asset other than XRP to top Thailand’s chart. Bitcoin and Ethereum rounded out the top three performers in August.

Thailand’s cryptocurrency market continues to expand. Monthly trading volume rose 2.05% to 299.4 billion baht (about US$8.2 billion), while the number of active accounts increased 8.44% to 230,000. Retail investors made up the largest share of trading at 42%, followed by institutional investors (21%), juristic persons (18%) and foreign investors (16%).

Despite growing adoption, crypto remains barred as a means of payment in Thailand, with exceptions such as a pilot program for tourist transactions. On social media, some users noted that crypto could provide an alternative for over 3 million locals recently cut off from bank access in a nationwide crackdown on “mule accounts” — once-legitimate bank accounts rented or sold to illicit actors.

Locals will have to ramp up on their crypto wallet literacy if they want alternative methods to hold their assets. The crackdown also includes cryptocurrency exchanges.

AnchorX’s Chinese yuan-pegged stablecoin

A Kazakhstan-based stablecoin issuer has launched a digital token pegged to the offshore Chinese yuan.

AnchorX said in February that it received an in-principle approval from Kazakhstan’s financial authority to issue its offshore yuan-pegged stablecoin AxCNH on Conflux, a public blockchain that has received policy support in China. AxCNH will target settlement and payments for overseas Chinese firms and partners of the Belt and Road Initiative, Beijing’s ambitious global trade strategy.

China’s trade with BRI partner nations reached 22.1 trillion yuan (about $3.1 trillion) in 2024, with over half of its imports coming from BRI partner countries.

The launch of a yuan-pegged stablecoin does not necessarily signal a shift in China’s crypto stance or suggest that Beijing is preparing to greenlight stablecoins, despite recent rumors. The issue has long been contentious among global crypto users, as investors in the world’s second-largest economy remain barred from core activities such as trading and mining.

China’s currency, the renminbi, operates in two distinct markets. The onshore yuan (CNY) circulates within the mainland under strict capital controls and cannot freely flow across borders. Its counterpart, the offshore yuan (CNH), is used internationally for trade and payments.

Following the introduction of Hong Kong’s stablecoin regulations, major Chinese firms reportedly lobbied the central bank for permission to issue yuan-pegged stablecoins in the city, which serves as the largest market for CNH. However, more recent reports indicate that some Chinese companies may be pulling back from Hong Kong’s stablecoin race.

Shanghai court sells Filecoin in Hong Kong

A Shanghai district court has carried out the city’s first sale of cryptocurrency seized in a criminal enforcement case, under guidance from the Shanghai Higher People’s Court.

The Baoshan District People’s Court disposed of more than 90,000 Filecoin, following procedures that mirror a framework unveiled by Beijing police in June for handling seized digital assets.

Under the system, courts entrust tokens to a licensed institution, which delegates trading to a qualified agent. Transactions are executed on a Hong Kong–licensed cryptocurrency exchange at no less than the 20-day average price. Proceeds are then transferred to the court’s account, where they can either be confiscated into the state treasury or returned to the victims.

The Shanghai High Court said the move marked their first successful disposal of digital assets, closing a gap where previous cases lacked a legal path for liquidation.

Crypto industry to escape annual grilling from South Korean lawmakers

Stablecoins are set to dominate cryptocurrency-related discussions in South Korea’s upcoming annual parliamentary audit.

In previous years, crypto audits often featured lawmakers grilling financial regulators and exchange executives over market failures and manipulation. Last year, the Financial Services Commission was accused of favoring the monopolies of major exchanges.

But throughout 2025, the local industry has not seen the high-profile scandals or major cases of market manipulation that typically trigger such confrontations. As a result, major exchange executives are unlikely to be summoned this year. Instead, attention is shifting to stablecoins, a policy priority for President Lee Jae-myung, whose administration took office in June on a crypto-friendly stance.

According to local media citing unnamed sources, legislators are expected to request data from exchanges on inflows and outflows of US dollar-pegged stablecoins.

The National Assembly’s audit is scheduled to begin around Oct. 13, immediately after Chuseok, a holiday often described as Korea’s Thanksgiving. Lawmakers on the National Policy Committee, which oversees financial and crypto-related issues, have already begun drafting witness lists.

Yohan Yun

Binance launches $1B BSC fund, BTC futures ETF approval could arrive soon, and Celsius raises $400M: Hodler’s Digest, Oct. 10-16

The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — one week on Cointelegraph in one link!

Read moreUS Fed begins quantitative tightening, Japan restricts stablecoin issuance and LUNA 2.0 rides a price roller coaster: Hodler’s Digest, May 29-June 4

The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — one week on Cointelegraph in one link!

Read moreCrypto loves Clawdbot/Moltbot, Uber ratings for AI agents: AI Eye