Top Stories of The Week

Coinbase predicts trillion-dollar stablecoin era by 2028

The total US dollar-pegged stablecoin market is projected to swell to $1.2 trillion by 2028, spurred on by comprehensive crypto regulations in the United States, according to crypto exchange Coinbase.

Coinbase said the projections mean the US Treasury issuance would have to be $5.3 billion per week over the next three years to satisfy demand from stablecoin issuers, who use short-term US Treasury bills as backing collateral for their digital fiat tokens.

This issuance schedule would cause a minor and temporary drop in three-month Treasury yields of about 4.5 basis points, contrary to analyst predictions that demand from stablecoin issuers will significantly reduce the interest on US government debt. Coinbase wrote in a market report:

“We think the forecast doesn’t require unrealistically large or permanent rate dislocations to materialize; instead, it relies on incremental, policy-enabled adoption compounding over time.”

Kanye West YZY sniper wallet linked to $21M LIBRA extraction scheme: Analysts

An onchain investigation by pseudonymous analyst Dethective linked a wallet that sniped the Kanye West-themed token YZY to another set of wallets behind the LIBRA token, suggesting that the same operator extracted tens of millions of dollars using insider knowledge.

In a series of X posts on Thursday, Dethective revealed that a YZY sniper wallet managed to buy $250,000 worth of tokens at just $0.20, far below the price most traders paid. Within minutes, the wallet secured over $1 million in profit, which was later funneled into a treasury wallet.

The same treasury wallet had also received large sums from wallets tied to LIBRA’s launch six months ago. Two “Libra sniper” wallets extracted a combined $21 million. In total, nearly $23 million was pulled across the YZY and LIBRA launches, with funds later moved to Kamino or Binance.

“We can be sure this is someone with clear inside info,” Dethective wrote. “The proof is that he did not snipe any coin besides $YZY and $LIBRA and he was prepared with huge size.”

Bitcoin’s 4-year cycle may not be dead after all: Glassnode

Bitcoin’s recent price action may still be tracking its historic four-year halving cycle, despite some market predictions that increasing institutional interest will break the pattern, according to onchain analytics firm Glassnode.

“From a cyclical perspective, Bitcoin’s price action also echoes prior patterns,” Glassnode said in a markets report on Wednesday.

Glassnode said several factors suggest that the Bitcoin cycle may be further along than the market assumes.

Profit-taking among long-term holders — those holding Bitcoin for more than 155 days — is now “comparable to past euphoric phases, reinforcing the impression of a market late in its cycle,” it said.

Glassnode also pointed to weakening demand, with capital inflows into Bitcoin “showing signs of fatigue.” Spot Bitcoin exchange-traded funds have posted outflows of about $975 million over the past four trading days, according to Farside Investors.

Harvard economist admits he was wrong about Bitcoin crashing to $100

Harvard economist Kenneth Rogoff, who once predicted Bitcoin would more likely crash to $100 before it hit $100,000, admitted that a lot has changed since his comments seven years ago, though he seemingly still hasn’t come around to Bitcoin.

“Almost a decade ago, I was the Harvard economist that said Bitcoin was more likely to be worth $100 than 100K. What did I miss?” Rogoff wrote on X on Wednesday, referring to a segment on CNBC’s “Squawk Box” in March 2018.

Rogoff is a former chief economist of the International Monetary Fund and also author of Our Dollar, Your Problem, a book published in May.

In 2018, Rogoff said that government regulation would trigger a drop in Bitcoin prices.

Philippine bill charts path to strategic reserve with 10,000 Bitcoin

The Congress of the Philippines is weighing a proposal that could see the country’s central bank establish a strategic reserve of 10,000 Bitcoin, positioning the country among the first in Southeast Asia to adopt Bitcoin as a strategic asset.

A House of Representatives bill filed by Camarines Sur Representative Migz Villafuerte in June made headlines on Thursday, as it aims to mandate the Banko Sentral ng Pilipinas (BSP), the country’s central bank, to purchase 2,000 Bitcoin annually over a five-year period.

The bill, called the “Strategic Bitcoin Reserve Act,” aims to mandate the BSP to buy 10,000 Bitcoin worth $1.1 billion at current market prices. The bill states that the asset would be locked in a trust for at least 20 years. This would mean that the coins could not be sold, swapped or disposed of, except for when retiring government debt.

Winners and Losers

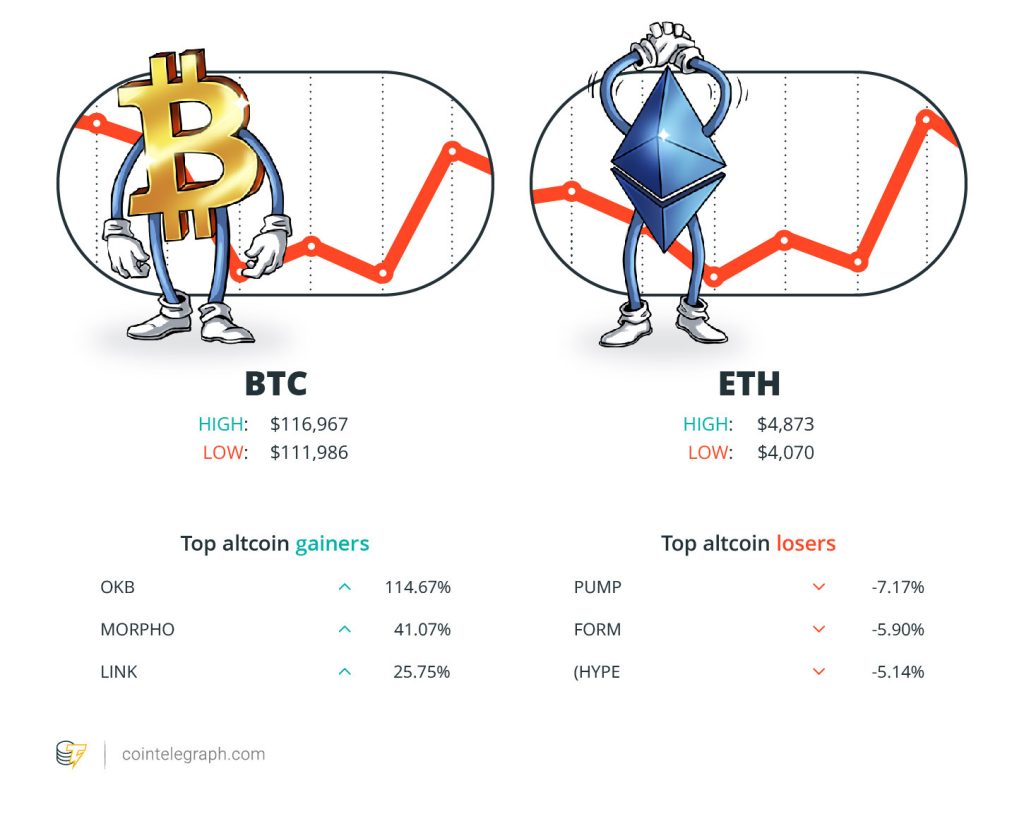

At the end of the week, Bitcoin (BTC) is at $116,967, Ether (ETH) at $4,873 and XRP at $3.09. The total market cap is at $4.05 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are OKB (OKB) at 114.67%, Morpho (MORPHO) at 41.07% and Chainlink (LINK) at 25.75%.

The top three altcoin losers of the week are Pump.fun (PUMP) at 7.17%, Four (FORM) at 5.90% and Hyperliquid (HYPE) at 5.14%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“From the SEC’s perspective, we will plow forward and on this idea that just the token itself is not necessarily the security, and probably not. There are very few, in my mind, tokens that are securities, but it depends on what’s the package around it and how that’s being sold.”

Paul Atkins, chair of the US Securities and Exchange Commission

“Retail traders have done a complete 180 after Bitcoin failed to rally and dipped below $113,000.”

“This is not a sign of strength for $BTC. The downward pressure is palpable, but bulls are trying to find their footing.”

Keith Alan, co-founder of Material Indicators

“The rough idea I have in my head is that we’ll see a million-dollar Bitcoin by 2030.”

Brian Armstrong, CEO of Coinbase

“If we don’t get the market structure right and the switch flips back to a more hostile policy or regulatory environment, I think there is a very credible risk that we will lose out to the EU, to APAC, or maybe even to the Middle East.”

Stuart Alderoty, chief legal officer at Ripple

“The way we buy Bitcoin is we do not move the price of the Bitcoin.”

Shirish Jajodia, corporate treasurer and head of investor relations at Strategy

Top Prediction of The Week

ETH ‘god candle’ emerges amid Fed rate cut hopes: Is $6K Ether next?

Ether’s price displayed strength at the Wall Street open on Friday, rising 13% to $4,788 following Federal Reserve Chair Jerome Powell’s speech at Jackson Hole.

ETH price rallied from $4,200 within minutes, reclaiming $4,600, a level that has suppressed the price over the last seven days, per data from Cointelegraph Markets Pro and TradingView.

That same day, ETH set a new record high, crossing above $4,867 on Coinbase for the first time since November 2021.

This performance follows Powell’s Jackson Hole speech, where he hinted at a potential interest rate cut in September, signaling a dovish stance that boosted market optimism.

Interest rate cut odds for the Sept. 17 FOMC meeting have now jumped to 91.5% from 75% a day prior, according to the CME Group Fedwatch tool.

Top FUD of The Week

Interpol coordinates crackdown on illegal Angola-based crypto miners

The International Criminal Police Organization, or Interpol, announced more than a thousand arrests and the seizure of about $100 million as part of a crackdown that included cryptocurrency miners and fraudsters.

In a Friday notice, Interpol said it had coordinated with authorities in Angola to dismantle 25 crypto mining centers being illegally run by 60 Chinese nationals.

The organization said it had seized equipment worth more than $37 million, which the Angolan government plans to distribute to “vulnerable areas.”

Coinbase tightens workforce security after North Korea remote-worker threats

Coinbase, the world’s third-largest cryptocurrency exchange by volume, has come under a wave of threats from North Korean hackers seeking remote employment with the company.

North Korean IT workers are increasingly targeting Coinbase’s remote worker policy to gain access to its sensitive systems.

In response, Coinbase CEO Brian Armstrong is rethinking the crypto exchange’s internal security measures, including requiring all workers to receive in-person training in the US, while people with access to sensitive systems will be required to hold US citizenship and submit to fingerprinting.

“DPRK is very interested in stealing crypto,” Armstrong told Cheeky Pint podcast host John Collins in a Thursday episode. “We can collaborate with law enforcement […] but it feels like there’s 500 new people graduating every quarter, from some kind of school they have, and that’s their whole job.”

Taiwan charges suspects in record $72M crypto laundering scheme

Taiwanese prosecutors reportedly indicted 14 people in what they say is the country’s biggest-ever cryptocurrency money laundering case, involving more than 1,500 victims and over $70 million in illicit funds.

The Shilin District Prosecutors Office indicted the 14 on charges related to fraud, money laundering and organized crime, requesting the confiscation of 1.275 billion New Taiwan dollars ($39.8 million), which was allegedly obtained from victims through fraud, according to a Friday report from local media outlet UDN.

Prosecutors also requested confiscation of another 640,000 USDT, undisclosed Bitcoin and Tron holdings, over $1.8 million in cash and two luxury cars. They reportedly seized bank deposits totaling $3.13 million, with the rest of the proceeds set to be recovered later.

The group was charged with laundering $71.9 million collected from unknowing victims in cash, before being converted into foreign currency and transferred overseas to purchase USDT through Taiwanese cryptocurrency exchange BiXiang Technology.

Top Magazine Stories of The Week

Can privacy survive in US crypto policy after Roman Storm’s conviction?

Roman Storm’s Tornado Cash conviction reflects the same privacy-versus-security struggle seen in earlier encryption battles, legal experts say.

Stablecoins in Japan and China, India mulls crypto tax changes: Asia Express

Major Asian economies step on the stablecoin throttle, India’s reconsiders punitive crypto tax, and more.

Bitcoin’s long-term security budget problem: Impending crisis or FUD?

The declining block reward subsidy is a genuine issue for Bitcoin’s security budget. But there are solutions, too.

Editorial Staff

XRP ETF pump ‘disappointment,’ Bitcoin to see out 2025 at $173K: Trade Secrets

XRP is more likely to see profit taking than a price surge, while Polymarket odds favor SOL, BTC and ETH hitting new highs this year.

Read moreWho takes gold in the crypto and blockchain Olympics?

The crypto and blockchain Olympics are here — Cointelegraph hands out medals in its unique take on the global showpiece.

Read moreIronClaw rivals OpenClaw, Olas launches bots for Polymarket — AI Eye