|

|

Top Stories of The Week

SEC dismisses lawsuit against crypto exchange Coinbase

The US Securities and Exchange Commission has dismissed its lawsuit with crypto exchange Coinbase on Feb. 27, filings show, ending the case permanently.

The SEC agreed to voluntarily dismiss all litigation tied to Coinbase and Coinbase Global with prejudice, which included withdrawing from its initial June 2023 lawsuit and its request for an interlocutory appeal with the US Court of Appeals, a Feb. 27 court filing shows.

It comes after the two parties announced an agreement to end the legal dispute on Feb. 21.

Bitcoin sheds nearly all Trump election gains in plummet under $80K

Bitcoin has fallen under $80,000 for the first time since November amid mounting macroeconomic uncertainty over US President Donald Trump’s proposed tariffs.

On Feb. 27, Bitcoin plummeted to $79,752, according to TradingView data. The 2.65% price decline over the past hour led to $100.01 million in long positions liquidated, per CoinGlass data.

Bitcoin last traded at this level on Nov. 11, just days after Trump was elected US president, amid optimism that his pro-crypto policies would lead a Bitcoin rally in 2025.

Over the past couple of days, most crypto traders eyed $82,000 as a potential bottom for Bitcoin, but many are now bracing for a move toward $70,000.

US judge tosses SEC fraud suit against Hex founder Richard Heart

A district court judge has dismissed the US securities regulator’s lawsuit accusing Hex founder Richard Heart of raising over $1 billion through unregistered crypto offerings and defrauding investors of $12.1 million.

Heart, whose real name is Richard Schueler, was also accused of spending those allegedly stolen funds on luxury items — including the world’s largest black diamond.

However, Judge Carol Bagley Amon said those alleged deceptive acts couldn’t be decided on as the US Securities and Exchange Commission failed to establish that the US had jurisdiction over Heart’s crypto activities — which she said were global in scope and not specifically targeted at US investors.

SEC again delays Ether ETF options on Cboe

The US Securities and Exchange Commission has once again extended its deadline for deciding whether or not to permit Cboe Exchange to list options tied to Ether exchange-traded funds (ETFs).

The agency has given itself until May to make a final decision to approve or disapprove of Ether ETF options trading on the US exchange, according to a Feb. 28 regulatory filing.

Cboe initially requested to list Ether ETF options in August 2024, but the SEC sought extra time to reach a decision in October.

The exchange is seeking to list options on the Fidelity Ethereum Fund. The fund is among the more popular Ether ETFs, with around $1.3 billion in net assets, according to data from VettaFi.

FBI asks node operators, exchanges to block transactions tied to Bybit hackers

The US Federal Bureau of Investigation has urged crypto node operators, exchanges and the private sector to block transactions from addresses used to launder funds from the $1.4 billion Bybit hack.

The FBI confirmed the results of an earlier industry investigation, stating that North Korea was responsible for the hack, which the US law enforcement agency dubbed “TraderTraitor” in a Feb. 26 public service announcement.

The FBI noted in an April 2022 statement that TraderTraitor is commonly referred to in the industry as the Lazarus Group, APT38, BlueNoroff and Stardust Chollima.

Winners and Losers

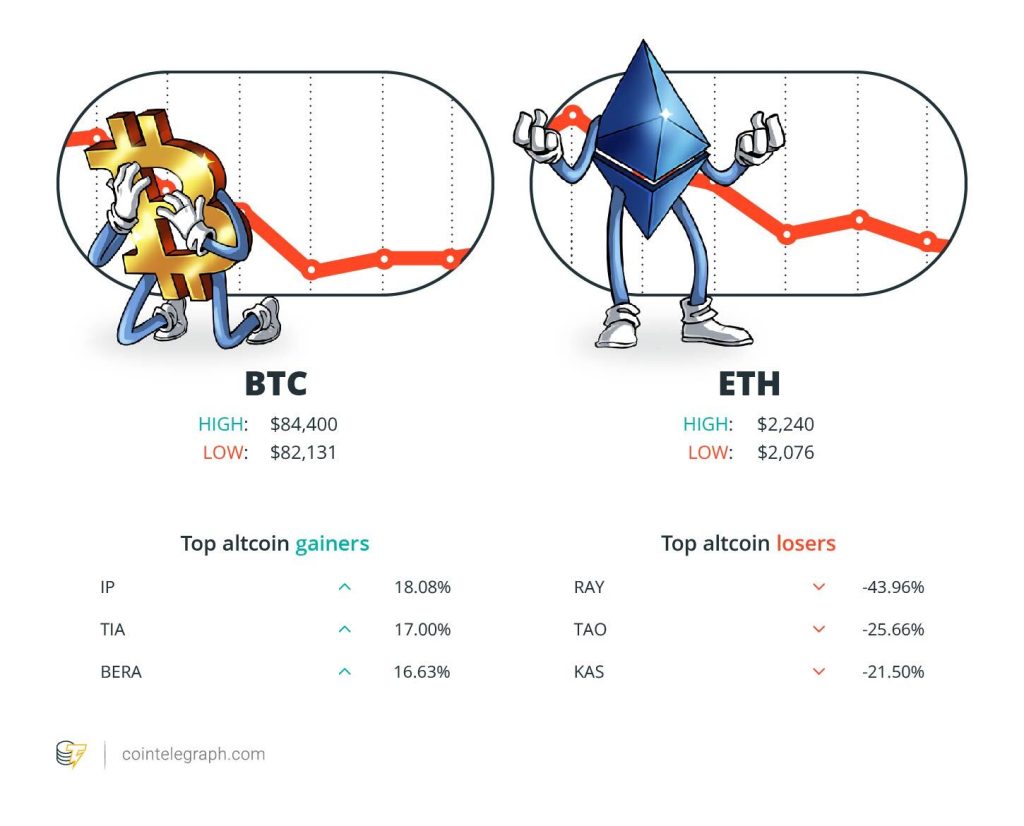

At the end of the week, Bitcoin (BTC) is at $84,400 Ether (ETH) at $2,240 and XRP at $2.15. The total market cap is at $2.81 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Story (IP) at 18.08%, Celestia (TIA) at 17.00% and Berachain (BERA) at 16.63%.

The top three altcoin losers of the week are Raydium (RAY) at 43.96%, Bittensor (TAO) at 25.66% and Kaspa (KAS) at 21.50%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“It’s time for the Commission to rectify its approach and develop crypto policy in a more transparent manner.”

Mark Uyeda, acting chair of the US Securities and Exchange Commission

“If GameStop embarks on the LBE (Leveraged Bitcoin Equity) strategy… It will bake the noodles of so many TradFi investors and commentators who think both GME and Bitcoin are a joke.”

John Haar, managing director of Swan Bitcoin

“The magnitude of skullduggery that is happening in Washington D.C. is really incredible. […] And it’s not over yet.”

Caitlin Long, founder and CEO of Custodia Bank

“We have quite a lot of bearish ‘sentiment’ confluence. Which historically has been a good marker for a potential dip/reversal opportunity.”

Charles Edwards, founder of Capriole Investments

“As the industry becomes more institutionalized, it should be safer.”

Geoffrey Kendrick, global head of digital asset research at Standard Chartered

“Crypto has been here before and bounced back even stronger.”

Richard Teng, CEO of Binance

Prediction of The Week

Bitcoin could hit $500K before Trump leaves office — Standard Chartered

US President Donald Trump’s first month in office has been highly volatile for risk assets, but his administration will likely be a net positive for Bitcoin in the long run, according to Standard Chartered.

In a Feb. 27 interview with CNBC, Standard Chartered’s head of digital assets research, Geoffrey Kendrick, said he expects Bitcoin’s price to reach $200,000 this year before surging to $500,000 prior to the conclusion of President Trump’s second term. He cited growing institutional adoption and the potential for clearer regulations as positive catalysts.

FUD of The Week

Virtuals Protocol revenue down 97% as AI agent demand fades

Virtuals Protocol, an AI agent platform enabling the creation and monetization of AI-driven virtual entities on the blockchain, has seen its daily trading revenue plummet by 96.8% despite expanding from Coinbase’s Ethereum layer-2 network, Base, to Solana.

According to Dune Analytics data, the protocol recorded its highest daily revenue of over $1 million on Jan. 2, but that figure had dropped to less than $35,000 as of Feb. 27.

Revenue from the Base virtual app has been particularly weak, with earnings remaining below $1,000 for 10 consecutive days, declining from its daily peak of $859,000 on Oct. 27, 2024. In total, Virtuals generated $28,492 on the Base network and $6,300 on Solana on Feb. 27.

Pi Network responds to Bybit CEO’s scam allegations

Pi Network has responded to a controversy triggered by a post from Bybit CEO Ben Zhou challenging the project’s legitimacy and accusing it of being a scam.

On Feb. 20, an X account describing itself as the “unofficial technical team” of Pi Network alleged that the project had rejected a listing offer from the crypto exchange and that Bybit was “losing its position” in the market.

Responding to the provocation, Zhou accused Pi Network of being a “scam,” citing a 2023 report from Chinese authorities warning users of a project targeting the elderly. “Yes, I still think you are a scam, and no, Bybit will not list scam,” Zhou wrote.

Zhou also stated that Bybit had never submitted a listing request to Pi Network and challenged the project to prove its legitimacy by addressing previous reports that questioned its operations.

Bitcoin crash triggered by erosion of ETF cash and carry trade — Analyst

Since reaching all-time highs on Jan. 20, Bitcoin’s price has been suppressed by hedge funds exploiting a low-risk yield trade involving spot exchange-traded funds (ETFs) and CME futures, signaling once again that institutional adoption of crypto assets isn’t a one-way street.

This is the general takeaway of analyst Kyle Chassé, who dissected the latest Bitcoin price crash in a thread on the X social media platform.

“For months, hedge funds were exploiting a low-risk yield trade using BTC spot ETFs & CME futures,” said Chassé. Now, this cash and carry trade is “imploding,” he said.

Top Magazine Stories of The Week

Elon Musk’s plan to run government on blockchain faces uphill battle

Overcoming bureaucratic inertia is bound to be difficult — but if anyone’s up for the task it would be the world’s richest man.

3AC-related OX.FUN denies insolvency rumors, Bybit goes to war: Asia Express

OX.FUN’s token holdings spur insolvency rumors, Bybit launches recovery portal in ‘war’ against North Korean hackers, and more.

Researchers accidentally turn ChatGPT evil, Grok ‘sexy mode’ horror: AI Eye

Researchers discover one simple trick to turn ChatGPT evil, and Grok’s chemical weapon instruction manual is only slightly less horrifying than ‘sexy mode.’

Ciaran Lyons

US gov’t messed up my $250K Bitcoin price prediction: Tim Draper, Hall of Flame

Tim Draper’s first big Bitcoin prediction came off without a hitch, but he says the current administration is making his second one look bad.

Read moreHow to protect your crypto in a volatile market: Bitcoin OGs and experts weigh in

Crypto OGs Brock Pierce and Tim Draper and other experts provide essential advice on how to protect your hard-earned stack.

Read moreWeb3 games shuttered, Axie Infinity founder warns more will ‘die’: Web3 Gamer