|

|

Top Stories of The Week

Donald Trump signs executive order for Strategic Bitcoin Reserve

US President Donald Trump has signed an executive order that creates a “Strategic Bitcoin Reserve” and a “Digital Asset Stockpile,” both of which will initially use cryptocurrency forfeited in government criminal cases.

“Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve,” White House AI and crypto czar David Sacks said in a March 7 post on X.

“The Reserve will be capitalized with Bitcoin owned by the federal government that was forfeited as part of criminal or civil asset forfeiture proceedings,” he added.

Additionally, a March 6 fact sheet from the White House said the order also establishes a “U.S. Digital Asset Stockpile,” which Sacks said would be made up of cryptocurrencies other than Bitcoin.

SBF sent to solitary confinement over Tucker Carlson interview: Report

Former FTX CEO Sam “SBF” Bankman-Fried has reportedly been sent to solitary confinement after taking part in an interview with right-wing political commentator Tucker Carlson, which was not approved by prison authorities.

“This particular interview was not approved,” a representative for the US Bureau of Prisons told The New York Times on March 7.

According to a person briefed on the situation, after Bankman-Fried’s interview with Carlson was published, he was sent to solitary confinement at Brooklyn’s Metropolitan Detention Center, where he has been held since August 2023.

The Bureau of Prisons is said to have strict rules on who can communicate with inmates and how they can do so.

OCC lays out crypto banking after Trump vows to end Operation Chokepoint 2.0

The US Office of the Comptroller of the Currency (OCC) has eased its stance on how banks can engage with crypto just hours after US President Donald Trump vowed to end the prolonged crackdown restricting crypto firms’ access to banking services.

“Crypto-asset custody, certain stablecoin activities, and participation in independent node verification networks such as distributed ledger are permissible for national banks and federal savings associations,” the OCC said in a March 7 statement.

The OCC confirmed in a document titled “Interpretive Letter 1183” that OCC-supervised financial institutions no longer need “supervisory nonobjection” to engage with crypto-related activities.

“Today’s action will reduce the burden on banks to engage in crypto-related activities and ensure that these bank activities are treated consistently by the OCC,” Acting Comptroller of the Currency Rodney E. Hood said.

FDIC resists transparency on Operation Chokepoint 2.0 — Coinbase CLO

Some US government agencies continue to deny transparency regarding their role in Operation Chokepoint 2.0, a period during the Biden administration when crypto and tech founders were allegedly denied banking services, according to Coinbase chief legal officer Paul Grewal.

The collapse of crypto-friendly banks in early 2023 sparked the first allegations of Operation Choke Point 2.0. Critics, including venture capitalist Nic Carter, described it as a government effort to pressure banks into cutting ties with cryptocurrency firms.

Despite recent regulatory shifts, agencies like the Federal Deposit Insurance Corporation (FDIC) continue to “resist basic transparency” efforts, Grewal said in a March 8 post on X.

“They haven’t gotten the message,” he wrote.

US will use stablecoins to ensure dollar hegemony — Scott Bessent

United States Treasury Secretary Scott Bessent said the US government will use stablecoins to ensure that the US dollar remains the world’s global reserve currency during the White House Crypto Summit on March 7.

Bessent reiterated the Trump administration’s promise to end the war on crypto and committed to rolling back previous IRS guidance and punitive regulatory measures. Bessent then turned his attention to stablecoins and said:

“We are going to put a lot of thought into the stablecoin regime, and as President Trump has directed, we are going to keep the US [dollar] the dominant reserve currency in the world, and we will use stablecoins to do that.”

President Trump told the summit that he hopes lawmakers will get a comprehensive stablecoin regulatory bill to his desk before the August congressional recess.

“I think there’s more than 50% chance we will see all-time highs before the end of June this year.”

Winners and Losers

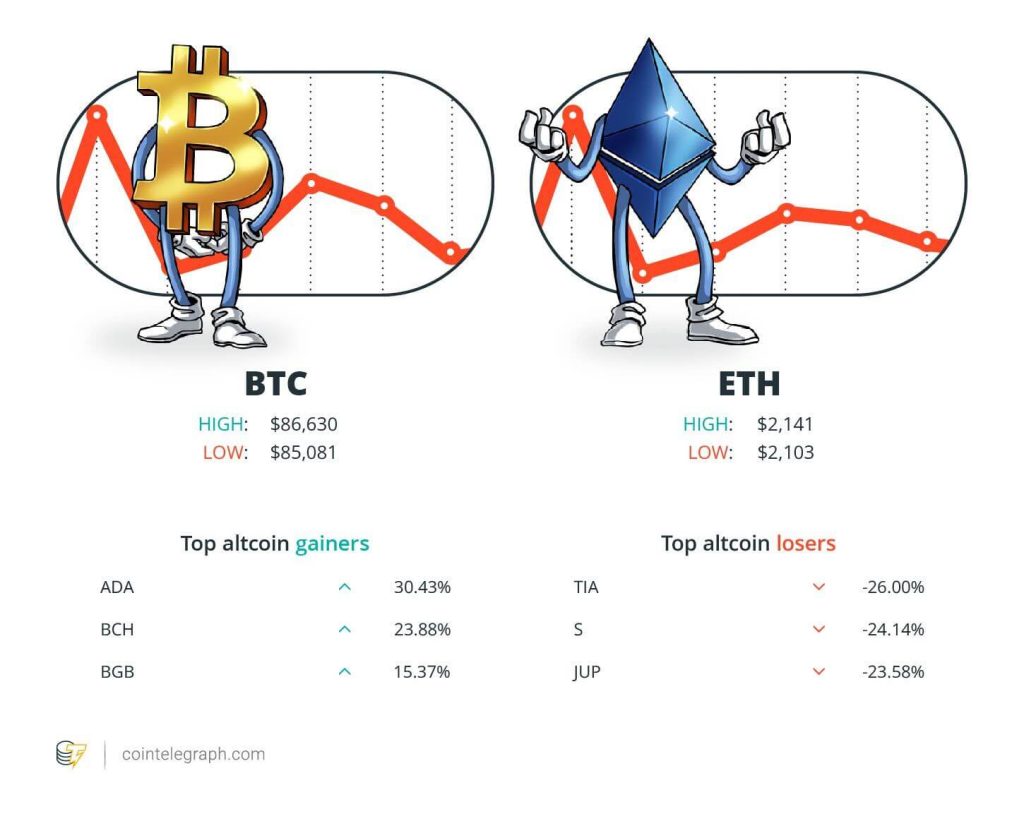

At the end of the week, Bitcoin (BTC) is at $86,630 Ether (ETH) at $2,141 and XRP at $2.39. The total market cap is at $2.85 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Cardano (ADA) at 30.43%, Bitcoin Cash (BCH) at 23.88% and Bitget Token (BGB) at 15.37%.

The top three altcoin losers of the week are Celestia (TIA) at 26.00%, Sonic (prev. FTM) (S) at 24.14% and Jupiter (JUP) at 23.58%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“I think there’s more than 50% chance we will see all-time highs before the end of June this year.”

Cory Klippsten, CEO of Swan Bitcoin

“The launch of TRUMP and MELANIA marked the top for memecoins as it sucked liquidity and attention out of all the other cryptocurrencies.”

Bobby Ong, co-founder of CoinGecko

“I don’t think I was a criminal.”

Sam Bankman-Fried, former CEO of FTX

“Just a few minutes ago, President Trump signed an Executive Order to establish a Strategic Bitcoin Reserve.”

David Sacks, White House AI and crypto czar

“We knew nothing about ADA being selected for the reserve. It was news to me.”

Charles Hoskinson, Cardano founder

“If it didn’t stop when the world ostracized us and most ‘bitcoiners’ abandoned us, it won’t stop now, and it won’t stop in the future.”

Nayib Bukele, president of El Salvador

Top Prediction of The Week

Bitcoin has ‘more than 50% chance’ of new high by June: Cory Klippsten

The chances of Bitcoin surpassing its all-time high of $109,000 by June are favorable, but the market first needs time to absorb volatile macroeconomic conditions, says Swan Bitcoin CEO Cory Klippsten.

“I think there’s more than 50% chance we will see all-time highs before the end of June this year,” Klippsten told Cointelegraph.

However, he said that market participants first need to adapt to US President Donald Trump’s tariff threats and the uncertainty around inflation rates.

“The market needs to first digest tariffs, trade war fears, and growth scare fears. Bitcoin trading below $100,000 right now feels like a pause, not an end to the bull run,” he said.

Top FUD of The Week

Memecoins are likely dead for now, but they’ll be back: CoinGecko

Enthusiasm for memecoins appears to have cooled after a series of bad launches and rug pulls killing off investor interest, according to CoinGecko founder Bobby Ong.

Metrics for token launchpad Pump.fun immediately plummeted following the Libra (LIBRA) rug pull, Ong said in a March 6 report, with newly created tokens and daily graduated tokens on the platform falling over 90% since their February peak.

“The launch of TRUMP and MELANIA marked the top for memecoins as it sucked liquidity and attention out of all the other cryptocurrencies,” Ong said.

US sanctions crypto addresses linked to Nemesis darknet marketplace

US authorities have sanctioned the operator of a shuttered online darknet marketplace, including his crypto addresses, which recently profited from Bitcoin price fluctuations.

Iran-based Behrouz Parsarad established the darknet marketplace Nemesis in 2021 and used it to facilitate the sale of drugs, false identification documents, professional hacking resources, and a variety of other illicit services for cybercriminals, the US Office of Foreign Assets Control said in a March 4 statement.

Under the sanctions, US citizens are now blocked from dealing with Parsarad and any companies where he owns more than a 50% stake.

Solana sees $485M outflows in February as crypto capital flees to ‘safety’

Solana saw nearly half a billion dollars in outflows last month as investors shifted to what were perceived to be safer digital assets, reflecting growing uncertainty in the cryptocurrency market.

Solana was hit by over $485 million worth of outflows over the past 30 days, with investor capital mainly flowing to Ethereum, Arbitrum and the BNB Chain.

The capital exodus came amid a wider flight to “safety” among crypto market participants, according to a Binance Research report shared with Cointelegraph.

“Overall, there is a broader flight towards safety in crypto markets, with Bitcoin dominance increasing 1% in the past month to 59.6%,” the report stated.

Top Magazine Stories of The Week

SEC’s U-turn on crypto leaves key questions unanswered

Crypto is winning key legal battles in the US and growing in importance on the global stage — but the fight for regulatory clarity continues.

Meet lawyer Max Burwick — ‘The ambulance chaser of crypto’

The New York-based lawyer suing Pump.fun and the creators of the Hawk Tuah memecoin says that when you’re in the public eye, “you’re bound to catch heat.”

Mystery celeb memecoin scam factory, HK firm dumps Bitcoin: Asia Express

Shenzhen memecoin factory rumored to be behind celeb scams, Hong Kong firm sells most of its Bitcoin, Telegram scam crackdown, and more.

Editorial Staff

6 Questions for Mati Greenspan of Quantum Economics

“I always take joy in seeing people quit their square jobs to work for Bitcoin and do my best to help facilitate that.”

Read moreCould a financial crisis end crypto’s bull run?

Blockchain technology doesn’t exist in a vacuum, and the outside world has become a less secure place. Could crypto survive a TradFi collapse?

Read moreBitcoin’s critical level is $82.5K, Ethereum ‘not done yet’: Trade Secrets