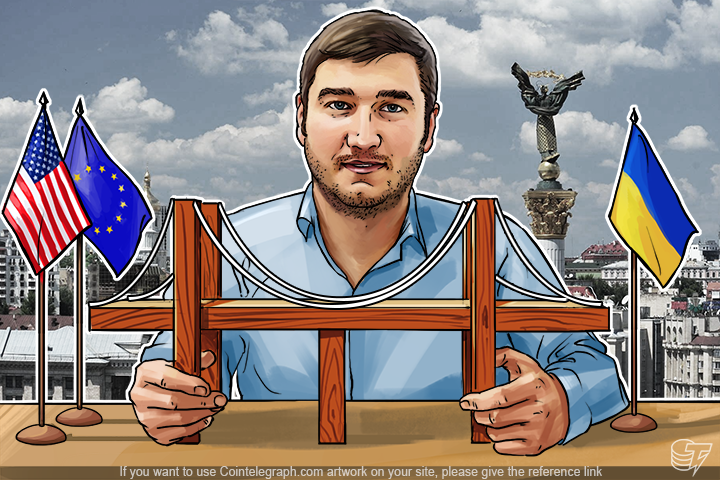

Dr. Pavel Kravchenko is currently an advisor at decentralized platform Decent and co-founder of DistributedLab. He does a great job on raising Bitcoin and Blockchain awareness in Ukraine, giving lectures and organizing conferences and meetups. Pavel also is an organizer and a think-tank of the BIP001 conference, which aims to raise Bitcoin and Blockchain awareness among Ukrainians and establishing bridges between EU, US and Ukrainian markets. Cointelegraph is a media partner for the conference. Our task is to outline the main issues of the Ukrainian crypto market that will be discussed at the conference. Pavel kindly agreed to discuss with Cointelegraph the main problems affecting the crypto industry in Ukraine.

CT: How difficult is it to promote Bitcoin and Blockchain in Ukraine? Which problems do these technologies face in the country?

Pavel Kravchenko: Cryptocurrency itself is quite popular in Ukraine. There are plenty use cases for it, from payments to freelancers to investing and offshore transactions.

“It’s one of the simplest payment methods and besides, Ukraine has a leading position in buying and selling Bitcoins. So it’s quite easy to enter the market here.”

Concerning Blockchain, I believe it’s too early to speak about some significant progress. The technology is still new and unknown here but we’re trying to have a closer look at it. The Odessa government plans to hold the first real estate auction on the blockchain. It is part of a bigger project to set up the first E-Governance system. Besides, there are some more projects that could help promote Blockchain in Ukraine but it will definitely take some time to do that.

As for the problems, I see only one thing – a lack of Bitcoin and Blockchain awareness. Many people simply don’t know these technologies even exist. That’s why I work on organizing educational events and give free lectures on Bitcoin and Blockchain to spread the awareness among the majority of people. It could help us speed up the adoption of Bitcoin and make it a popular payment method in Ukraine. The one reason for this is that Bitcoin is easily convertible into USD, which could allow businesses to accept payments without tying to the UAH rate.

Our crypto market is still young but we already have several reliable exchange platforms for people to work with. KUNA and UTBS provide their customers with reliable and easy-to-do services but there are several other platforms that work well.

CT: And how does the Ukrainian government treat Bitcoin and Blockchain? Are banks friendly to those innovations?

PK: The government is neutral towards Bitcoin and Blockchain and so are banks. The market niche is too small to attract their attention. But there were some situations which outline a bit of controversy of Bitcoin’s position in Ukraine.

First of all, there are still discussions about the status of Bitcoin; whether it should be considered as e-money or not. It results in numerous discussions on whether Bitcoin should be taxable or licensed. Besides, the Ukrainian Security Service representatives often visit people who do Bitcoin businesses as cryptocurrency is the easiest way to provide financing to terrorists.

“But on the other hand there are a lot of projects that show Bitcoin has a bright future in Ukraine. Besides, there are no regulative or legal limitations to its development and that is really good at the moment.”

CT: Everyone talks about the integration of Ukraine into the EU zone. Does that concerns the Ukrainian crypto industry as well? Do you have some established contacts with markets in other countries?

PK: If we talk about the technology, there certainly are some connections. Ukrainian developers and companies actively cooperate with foreign partners in the field of providing Bitcoin and Blockchain solutions. We develop a lot of projects in cooperation with foreign companies. Actually, Ukraine is quite famous in the sphere. Many companies are searching for Ukrainian developers on purpose.

If we talk about e-commerce, there are no business relations with other markets. The main reason for this is the great difference in the regulations of different countries. To cooperate successfully, we need the same – or nearly the same – rules everywhere. And that seems impossible at the moment as different countries treat Bitcoin currency differently.

CT: Which Ukrainian companies provide Bitcoin and Blockchain solutions to deal with the existing problems of Ukrainian crypto industry?

PK: There are plenty of them, actually. DistributedLab is very active in this direction. It consists of 17 members; all of them are engaged in different global projects. Mike Chobanyan does a great job in developing Blockchain solutions as a head of Innovex’s project. Ambisafe has originally built its technology in Ukraine and still has an office here. There are many other well-known companies as well, but most of them prefer not to mention they have roots or teams in Ukraine.

“I suppose, Ukraine has more development centers than any other European country. Perhaps, we can’t boast of our startups as their number is much less significant, but we’re definitely the leaders in solutions development. Besides, Ukraine has the biggest Bitcoin community in Eastern Europe.”

We may see that Ukraine provides a great environment for Bitcoin and Blockchain. With no governmental or regulatory limitations, the technology has a great potential and, sooner or later, we will have the opportunity to integrate with European markets.