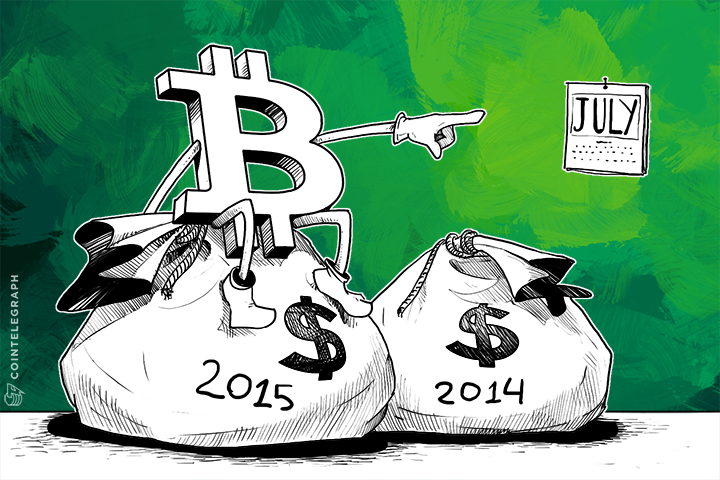

While large-scale national economies are slipping into default and long-term indebtedness, the Bitcoin economy couldn’t be more robust in 2015. Newly updated totals show that Bitcoin’s level of venture capital funding and investment has obliterated 2014 year-end totals after just over six months.

Amsterdam’s BitFury puts 2015 over the top

The news comes after US$20 million of capital was injected into Amsterdam Bitcoin mining company BitFury last week. Investors included iTech capital, DRW venture Capital and the Georgian Co-Investment Fund for expansion plans for a new data center in Georgia, plus the acquisition of all the latest in mining chips to keep up with the fierce global mining competition.

“You need access to capital,” BitFury’s Vice Chairman Mr. Kikvadze said to the Wall Street Journal, “as well as execution on silicon. That’s super important. If you don’t come up with the chip in time and develop your data centers on time, you’ll be squeezed out.”

- image provided by Dan Morehead

Year-over-year

Some call Bitcoin the “son of the Internet” due to its decentralized nature of sharing digital information globally via the Internet. It seems that the youngster is moving forward just as fast, if not eclipsing the Internet’s investment appeal through its first six-plus years of service.

In 2012, few had even heard of Bitcoin, much less thought it worthy of capital investment when it just cracked US$2 million for the year. The next year saw interest explode to just under US$100 million, and venture capital funding for companies like blockchain.info more than tripled in 2014, to US$350 million. With the BitFury deal, totals for 2015 have passed US$357 million for the year with almost half the year remaining.

In comparison, the Internet had acquired approximately US$250 million of capital investment in 1995, which would be about US$390 million in today’s inflated US Dollars. At its current pace, Bitcoin should have no problem passing that amount before the end of the summer. Bitcoin may be a chip off the old decentralized block.