In our Expert Takes, opinion leaders from inside and outside the crypto industry express their views, share their experience and give professional advice. Expert Takes cover everything from Blockchain technology and ICO funding to taxation, regulation, and cryptocurrency adoption by different sectors of the economy.

If you would like to contribute an Expert Take, please email your ideas and CV to a.mcqueen@cointelegraph.com

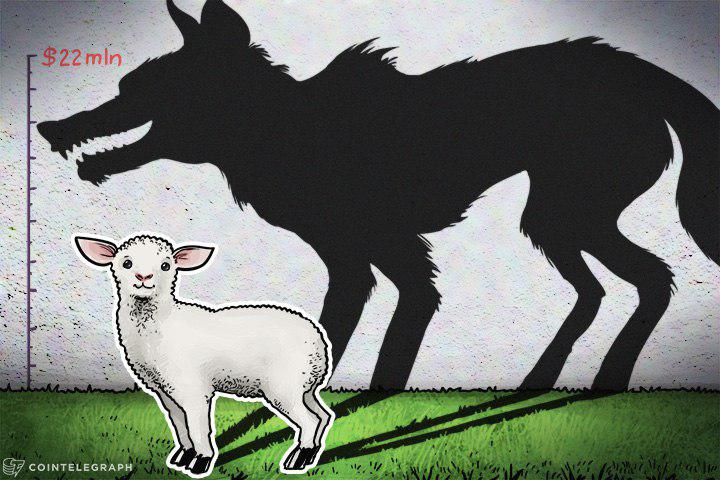

The majority of the world's financial markets are now tightly regulated, and for that reason, fraud is becoming increasingly rare. Enterprising scammers are turning to fintech innovation which is currently unregulated – cryptocurrency.

Essentially, a crypto scammer aims to persuade 'unwitting investors' to buy fake coins by transferring either fiat currencies or cryptocurrencies. In this column we will only focus on the so-called ‘ICO exit’ scam, not thefts, hacks or Ponzi schemes.

We define a project as a scam only when it is proven that the money collected during a pre-ICO or ICO was stolen and the team has disappeared. This means the fraud was preplanned and the theft of investor funds deliberate.

PlexCoin ($15 million)

The PlexCoin ICO was halted in December 2017 by the US Securities and Exchange Commission (SEC) in response to an official complaint that founder Dominic Lacroix was defrauding American and Canadian investors. The complaint alleged that Lacroix was advertising an astronomically high return of 1,354% (that the SEC determined was unable to be delivered), pushing forward a group of fake experts to bring legitimacy to his project, and trying to obscure his past financial crimes, which included defrauding investors in a micro-loan venture.

The SEC has frozen all of the $15 million gathered by the ICO from its launch in August 2017. Lacroix was jailed, and the PlexCoin parent company fined $100,000. About $810,000 was still being held by payment processing company Stripe while the rest of the funds were located in various cryptocurrency wallets belonging to the Lacroix. It’s unclear exactly what charges will be brought against Lacroix and what will happen to the money deposited in his wallets. However, PlexCoin was one of the largest attempted ICO exit scams in history, which thankfully was nipped in the bud.

Benebit ($2.7 - $4 million)

Benebit claimed to use a Blockchain token system to unify customer loyalty programs, like frequent flyer miles. This ICO had all the trappings of legitimacy, including a moderated Telegram channel with over 9,000 members, a marketing budget of over $500,000, and promotions for the token pre-sale. With a novel concept, a serious-sounding white paper, and some well-spent marketing dollars, the Benebit team were able to generate a good deal of hype, and investors began to buy in.

However, things started to go south when someone noticed that photos of the team appeared to have been stolen from a UK school for boys. Passport details provided by the ‘founders,’ were all fake. After this revelation, the team behind the scam began pulling down anything related to Benebit, including the website, white paper, and social media accounts. Estimates vary, but the scammers are believed to have walked away with at least $2.7 million and as much as $4 million.

Opair and Ebitz ($2.9 million)

A motivated community of small-time investors who put money into Opair and Ebitz are trying to track down a mysterious developer known only as Wasserman, the apparent mastermind behind two ICO scams which netted a combined total of 388 BTC.

Opair promoted a decentralized debit card system using its own token, XPO. Users discovered that the LinkedIn profiles of some of the team were fake and Opair rapidly vanished, but not before generating just under 190 BTC in its ICO in the summer of 2016.

Amateur investigations carried out by duped investors revealed that the mail servers for Ebitz were rerouting to the domain of Opair, which billed itself as a clone of ZCash with some small changes. The team, a self-described “group of ethical hackers,” were hoping to raise 500 BTC through their ICO, which started on November 28 2016. In two days users of BitcoinTalk spotted the shady connection of Ebitz’ MX records to Opair.

The Ebitz website was taken down soon afterwards, but the ICO did manage to gather about 200 BTC before disappearing; although many users speculate that the BTC mostly came from the developers to provide ‘fake volume,’ or the impression that many people had already invested in the project in order to boost trust and lure other investors to buy their token.

REcoin and DRC ($300,000)

On the face of it, REcoin (Real Estate coin) and DRC (Diamond Reserve Club) tried to do something ambitious and daring - create a cryptocurrency that was backed up with real-world assets - real estate and diamonds. Their founder Maksim Zaslavskiy claimed that both startups were fully staffed, lawyered up, and had already formed relationships with retailers and investors - none of which was true.

The SEC alleges that neither REcoin nor DRC had any “real operations”, that both startups had misrepresented their total level of investment, and that neither of the proposed projects had any tokens or anything to do with Blockchain whatsoever. SEC decided that REcoin and DRC weren’t ICOs at all and were actually securities, which led to Zaslavskiy’s arrest on September 29 2017. According to the SEC, Zaslavskiy did manage to rake in about $300,000 before being caught, despite he initially saying that funds raised from both ICOs amounted to over $2 million.

PonziCoin ($250,000)

Yes, PonziCoin is a real cryptocurrency, and yes, some very gullible people were separated from their money after investing in it. Even more surprising, the most recent PonziCoin, which bills itself as “the world’s first legitimate Ponzi scheme,” is actually the second PonziCoin to exist. The first one came out in 2014 and made off with about $7,000 in cryptocurrency, which by some estimates could have been worth over $2 million today.

Another PonziCoin project appeared in 2017 using the same web address.

Initially intended as a gag, it featured a public and open admission on its website that it was a scam. However, that didn’t stop some investors from pouring money into the ‘product.’ In total, a project, which openly admitted to being a scam, raised over $250,000, and, surprise, surprise, the ‘founder’ ran away with the cash (after being baffled that anyone would invest at all given their openness and honesty).

Six questions to ask

ICO exit scams thrive in the current environment of unbelievable profits, overwhelming hype, and the time-constrained nature of ICOs, which make investors feel like they need to invest quickly or risk losing out on a good deal. No matter if you are just starting out or are a seasoned investor, every single decision needs to be analyzed thoroughly - there is no substitute for due diligence. If you are considering investing in an ICO, we highly recommend taking the following steps:

- Read the ICO white paper thoroughly. Does the concept make sense to you?

- What problem is the product solving? Does it make business sense?

- Study the team and their experience. Get in contact with representatives and ask difficult questions. Dig into their history, LinkedIn profiles, and previous jobs. Helpful hint: scammers will sometimes use fake pictures. Google’s reverse image search will work wonders.

- Check forums to gain insight into what the cryptocurrency community is saying about the project. Many people there have been victims of ICO scams, so they will have a sharper eye for red flags.

- Make sure that the ICO is planning on using a trusted escrow company to handle funds for their ICO. Escrow gives you an additional layer of protection, ensuring that you will at least receive the promised tokens from the ICO before parting with your hard-earned capital.

- Take a look at what rating companies are saying about the ICO. If the new project isn’t rated, there’s a high chance that it’s a scam. Also be sure to check and compare risk scores.

We believe that cryptocurrency is the future and that this current period of uncertainty is temporary, it is still wise to be cautious and prudent before investing your hard earned fiat or cryptocurrency in new ventures.

The views and interpretations in this article are those of the author and do not necessarily represent the views of Cointelegraph.

This opinion article presents the contributor’s expert view and it may not reflect the views of Cointelegraph.com. This content has undergone editorial review to ensure clarity and relevance, Cointelegraph remains committed to transparent reporting and upholding the highest standards of journalism. Readers are encouraged to conduct their own research before taking any actions related to the company.