Bitcoin and blockchain technology have the ability to bring financial services to the unbanked that otherwise would be unavailable to them. Mexican mobile payments platform Saldo.mx allows to pay for their loved ones’ utility bills across borders. Saldo recently debuted a microinsurance service, Consuelo, to allow users to easily use a fixed health and life insurance policy.

Cointelegraph spoke with Marco Montes Neri, founder of Saldo, about the company’s blockchain-powered microinsurance initiative.

Cointelegraph: What prompted Saldo to start dealing in microinsurance?

Marco Montes Neri: Insurance in general has been always a very important thing for me and has the potential to reallocate the risk and create a better world. Insurance is broken and we have been thinking about a new model, something like non-adjustable insurance rather than micro insurance that may sound like cheap.

Microinsurance is more similar to what we think in the future with smart contracts will cover people from risks. What is interesting about this form of insurance is the removal of the middle man, the claim adjuster, and the society has evolved in such a way that has created authorities that with a very good level of certainty act as oracle that determine if something has happened or not. So combining those oracles and a blockchain that guarantees integrity of data of those who decided to cover themselves from some risks creates for the very first time powerful, non-adjustable coverage that we are now including as part of the Saldo offering.

Common timeline is crucial

CT: How does using a blockchain simplify this process?

MMN: The blockchain acts as verifiable data history. It’s the very first time financial world has something like that in a mutualized way. It’s a common timeline that in this industry will be crucial.

CT: Does the average intended user understand anything about blockchain technology?

MMN: Not at all, this is used only to make efficient the chain: Insurance company- broker - dealer. Users will only perceive simpler products, which is good for adoption.

CT: Do you foresee potential users as being reluctant to try out an insurance platform so simple, easy, and efficient without fully understanding why it is that way?

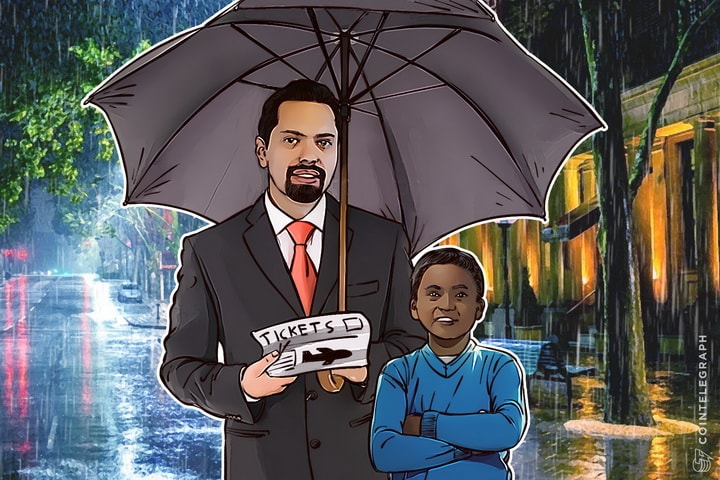

MMN: Sure, there are a lot of problems because people relate the word insurance with bureaucratic and complicated things. That is why we call this Consuelo, the spanish word for consolation. We need to do what insurers have been doing poorly over years, which is communicate how powerful a mechanism it is to have some money available in rainy days.

Community outreach

CT: Other Mexican Bitcoin companies have mentioned community outreach and education initiatives to grow the pool of potential customers. Is Saldo active in educating people about the benefits of using blockchain technology?

MMN: We are very active educating underbanked communities We even work with the Mexican foreign ministry in financial literacy events. But still, to specifically talk about the blockchain is too complex. That is why we decided to start educating financial institutions first. They are more familiar with the problems that blockchain solves like counterparty risk, or lack of trust.

CT: Where do you see most of your customer base: in Mexico itself, or immigrants in the US?

MMN: We are focused on the diaspora first as there are millions exposed to all sort of risks, but one of our products covers both: if the US immigrant dies, the family member in Mexico gets the “Consuelo,” and the other way around. So I’d say we have a community without borders approach.