In the last two months, OpenSea began to cool down from its New Year's bull run and many nonfungible token (NFT) pundits began to speculate about the beginning of a bear market once sales took a slight downward trend after closing out a record-breaking $5 billion in total volume sales in January.

However, for the last seven days, the total sales volume has already exceeded the $1 billion mark and just a week into April, it seems the NFT markets are waking up to a resurgence of blue-chip caliber projects. Cue the “spring awakening.”

Traders searching for the next Bored Ape Yacht Club (BAYC) project have patiently waited for another project to come in with the same force and brand equity. Some top contenders have been emerging. Azuki Zen, revealed on Jan. 21, has amassed over $574.6 million in total volume, and RTFKT Studios and Takashi Murakami's CloneX NFT avatar project has accumulated over $546.7 million. In the last seven days alone, CloneX has increased its total sales volume by over 180%.

NFT investors are coming to understand the benefit of investing for the long-term with teams that have delivered. RTFKT Studios catalyzed the community collective quest-solving for its MNLTH NFT, airdropped to all CloneX holders and valued at $22,135. As such, those who held their MNLTH were essentially airdropped over $22,000 simply for being a CloneX holder. This further illustrates for collectors and traders the value of grail NFTs.

Now that liquidity is pumping and circulating, it seems Q2 is here to blaze trails and the NFT markets appear to be ignited by more mature NFT communities and investors.

What will spark the next BAYC?

NFT projects are beginning to understand the value of intersecting culture, community and commerce through what BAYC cultivated, and many have explored ways to establish their own.

On a spectrum from estranged collector to maxi, NFT projects that have recently launched have paid close attention to not only building close-knit communities that hold strong convictions but ones that can utilize its platform to uplift their own personal creative pursuits.

RTFKT Studios has opened a platform for creators to shine via their Space Pod NFT airdrop, which allows owners to display their NFTs throughout the space. Currently valued at $4,920.86 (1.65 Ether), SpacePods are open for customization and this also allows RTFKT to scout for talent among their own community. Creators are also able to produce and sell their creations to others in the community to support and enjoy.

Currently, the floor price for a CloneX is a thin 17.5 Ether ($52,237.50). By holding an average sale price over 11.5 Ether, NFT collectors and owners trust that RTFKT Studios will continue to deliver.

Similarly, Yuga Labs announced the creation of its metaverse platform, MetaRPG, that will offer purchasable digital land. This news was compounded by ApeDAO not only airdropping the BAYC NFT ecosystem owners over $1.6 billion in ApeCoin and promising that it would become a utility currency adopted in the BAYC ecosystem and MetaRPG.

Since MetaRPG is slated to be an interoperable metaverse, it will not prevent those who are not in the BAYC ecosystem from gaining exposure. Those who have been paying attention know that there is tremendous value in interoperability for mass adoption and other projects with interoperable metaverses like Arcade Land.

Arcade Land is currently number three for total volume in the last seven days, closing in on approximately $23 million. Its average sale price has increased by 96% and whether that is just a pre-post reveal pump, it does suggest that communities are searching for the most viable interoperable worlds. The cheapest Arcade Land NFT is selling just under 1 Ether (3,291.15) and out of 10,000 items, there are over 5,700 unique wallet addresses.

NFT investors are focusing their bids on utility, interoperability and a semblance of cultural relevance. As of late, it seems well-known artists outside of the Web3 and NFT circles are carving their space in the ecosystem and gaining the attention of art collectors and NFT collectors.

There's value in bridging IRL art to digital spaces through NFT collections and experiences

RTFKT Studios set an example of how collaborating with a well-known artist can elevate the inherent value of a digital collection not only by mere association but by a mutual potential benefit. For example, CloneX partnered with Japanese contemporary artist, Takashi Murakami, whose influence is dripped into the collection on certain CloneX avatars inspired by his previous works.

Takashi Murakami created an allowlist for his Murakami.Flowers NFT collection and gave all Murakami dripped CloneX avatars (roughly 2,500) a spot on the list. On March 30, Murakami Flowers hit the secondary market and surged in volume from an average sale price of 6 Ether ($17,910) to the current 9.2 Ether ($27,462). In less than two weeks, the average sale price has increased by over 61%.

Crypto artist and Cyberbrokers creator, Josie Bellini introduced another level of detailed art that is technically innovative and layered with lore. According to NFT wallet trackers, 50% of CyberBrokers’ owners have bags that are composed of more blue chips than the average investor.

CyberBrokers’ average sale price has increased by over 274% since its launch. In the long-term, artworks that have been translated into digital may hold extra value for their historical relevance.

Another NFT collection called “MOAR” by Spanish artist Joan Catallan has risen to the top spot in the charts for total volume on OpenSea. Currently, it is up over 320% since it hit the secondary market on April 8, and is trading at 1.11 Ether ($3,283.50).

Presented by digital media company FWENCLUB, MOAR is 5,555 souls of creatures living in a mansion in the metaverse. There are over 3,700 unique wallet addresses that own a MOAR NFT and only time will tell how the community will develop.

NFT announcements could make Q2 quite exciting

Q2 could potentially have several liquidity pumping announcements in tow. NFT denizens have taken to Twitter to make their guesses, but there are a few impending project developments that could boost the overall morale and amount of liquidity in the market.

CyberBrokers NFT will be airdropping all owners a free NFT whose value could potentially increase as the CyberBrokers gaming ecosystem continues to unfold.

Similar to the ways RTFKT Studios initiates community-collective quest-solving for its MNLTH NFT, CyberBrokers announced on April 12 that all brokers will be receiving a cosmetic item for their NFT. Communities at large are almost beginning to expect their NFTs to unlock feature airdrops.

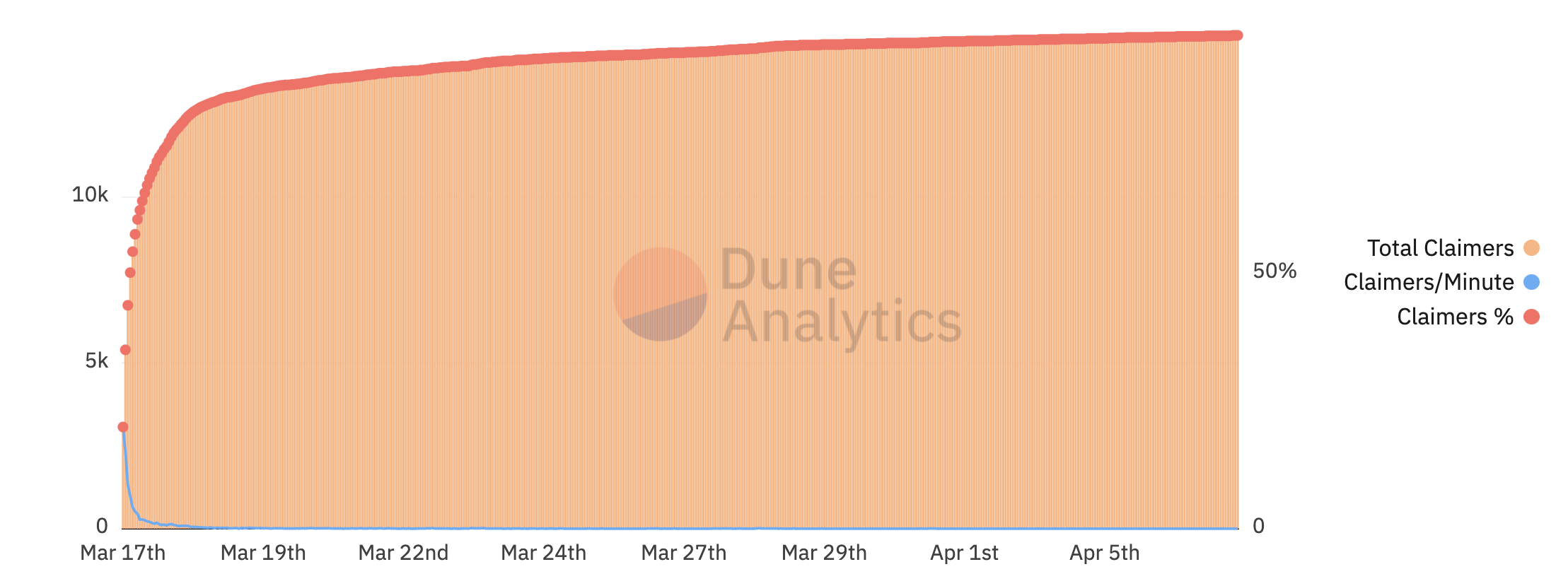

Azuki NFT airdropped two unrevealed red BEANZ NFTs to each respective owner, which stirred up controversy on Twitter regarding what they were and what they were worth. Those who are eligible to claim will be able to do so until April 14 and the reveal is scheduled for the following day. The Azuki NFT airdrop BEANZ excited the market, giving Azuki’s a runup past 25 Ether ($77,879). The mysterious NFT quickly pumped over 3 Ether ($9,440.10) and BEANZ is currently at 5.45 Ether ($16,268.25) while its average sale price is up over 44% since it hit the secondary market.

NFT pring appears to be blooming and collectors have refined their sensibilities and are looking to turn their initial investments into larger ones via the new mechanism of NFT airdrops.

Outside of token emission, collectors are now drawn to projects that are adding value to their communities by giving them free illiquid assets that quickly turn liquid. Although some NFT pundits claim airdrops dilute the collection, others are taking this opportunity to turn their liquidity into long-term investments that often compound the size of their portfolio. Pairing liquidity and collectors could make for a very fruitful Q2 for NFTs and the Web3 ecosystem.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.